Beyond Incorporation: Mastering Annual Compliance for Your Maltese Company – Returns, Audits, and Fees

Successfully completing your Malta company formation is a significant achievement, laying the groundwork for your business endeavors in this strategic EU jurisdiction. However, the journey doesn’t end with receiving your Certificate of Registration. To maintain your company’s good legal standing, avoid penalties, and ensure its continued smooth operation, you must diligently navigate a series of annual compliance obligations in Malta. These responsibilities, primarily involving filings with the Malta Business Registry (MBR) and the tax authorities, are non-negotiable.

Many entrepreneurs, particularly those managing businesses from overseas or new to the Maltese regulatory environment, can find these ongoing requirements daunting. What exactly needs to be filed each year? When are the deadlines? Is an audit always necessary for my company? What are the typical fees involved? Overlooking these crucial tasks can lead to late filing penalties, loss of good standing, and even, in severe cases, the company being struck off the register.

As dedicated corporate services consultants at Contact Advisory Services Ltd., a core part of our ongoing support involves ensuring our clients’ Maltese companies remain fully compliant year after year. This article provides a clear, comprehensive guide to the essential annual compliance for Maltese companies, focusing on annual returns, the preparation and filing of financial statements, audit requirements, and associated fees. Let’s ensure your Maltese venture thrives not just at inception, but for the long term.

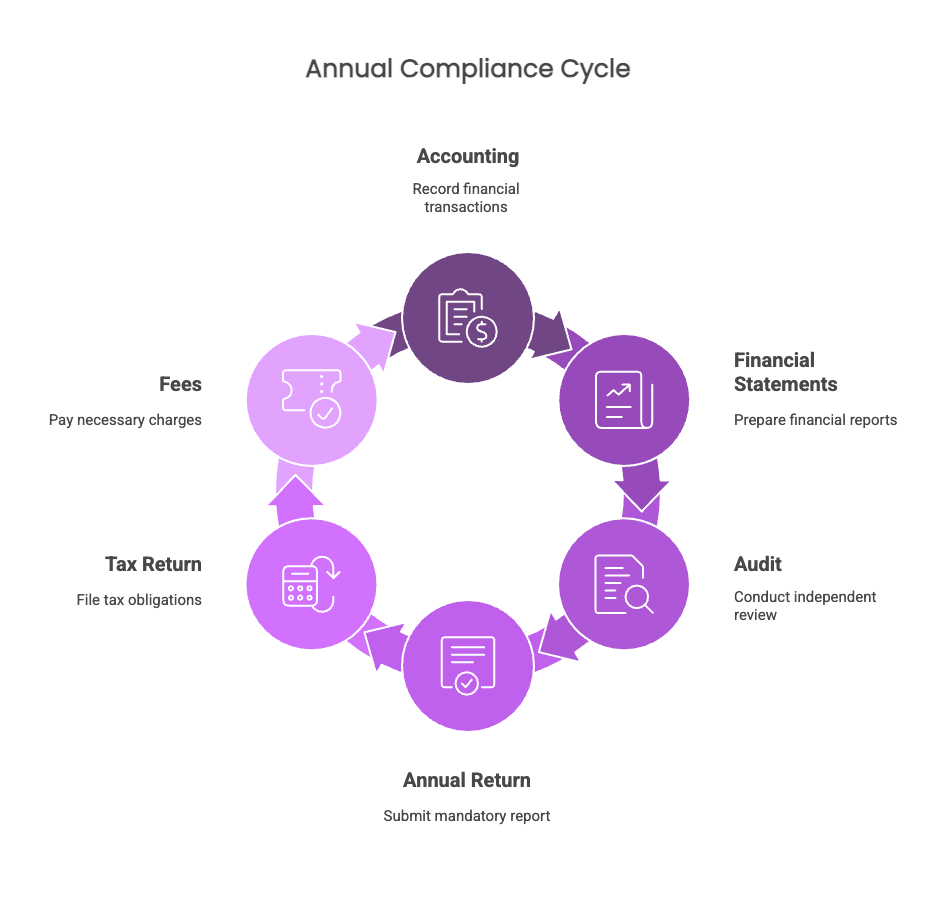

The Annual Cycle: Key Compliance Pillars for Maltese Companies

Once your Maltese company is registered, a recurring cycle of compliance tasks begins. The primary pillars of this annual cycle include:

- Maintaining Proper Accounting Records: This is a continuous obligation throughout the year, forming the basis for all other financial reporting.

- Preparation of Annual Financial Statements: Every Maltese company must prepare a set of financial statements for each financial year.

- Potential Statutory Audit: Depending on company size and type, these financial statements may need to be audited by a registered Maltese auditor.

- Filing of Annual Return with the MBR: A yearly update of company information.

- Filing of Annual Tax Return: With the Commissioner for Revenue.

- Payment of Annual Fees: To the MBR and potentially other bodies.

Let’s delve into each of these key areas.

1. Maintaining Proper Accounting Records: The Daily Grind for Annual Success

While not a single “annual” filing, the consistent and accurate maintenance of accounting records throughout the year is the bedrock of all annual financial compliance. Maltese law requires every company to keep proper books of account that:

- Correctly record and explain its transactions.

- Enable its financial position to be determined with reasonable accuracy at any time.

- Allow for the preparation of financial statements that comply with the Companies Act and International Financial Reporting Standards (IFRS) as adopted by the EU (or GAPSME for eligible smaller entities).

These records should include entries of all money received and expended, a record of assets and liabilities, and, if dealing in goods, statements of stock-takings.

Practical Implication: Whether you manage this in-house or outsource it, accurate bookkeeping is non-negotiable. It directly impacts the ease and accuracy of preparing your annual financial statements and tax returns. At Contact Advisory Services Ltd., while we are not accountants or auditors, we can certainly refer you to trusted professionals for these services.

2. Preparation of Annual Financial Statements: Your Company’s Financial Report Card

Every Maltese company, regardless of size or activity level (even dormant companies), is required to prepare annual financial statements for each accounting period (usually 12 months). These statements must provide a true and fair view of the company’s financial position and performance.

What do these statements typically include?

- Statement of Financial Position (Balance Sheet): Shows assets, liabilities, and equity at a specific point in time.

- Statement of Profit or Loss and Other Comprehensive Income (Income Statement): Shows revenues, expenses, and profit/loss over the accounting period.

- Statement of Changes in Equity: Tracks changes in the company’s equity.

- Statement of Cash Flows: Shows cash inflows and outflows.

- Notes to the Financial Statements: Provide detailed explanations and disclosures supporting the figures in the primary statements.

- Directors’ Report: A report by the directors on the state of the company’s affairs, its development, and performance.

Accounting Standards:

- Financial statements must generally be prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the EU.

- However, eligible small and medium-sized entities (SMEs) may opt to prepare their financial statements in accordance with GAPSME (General Accounting Principles for Smaller and Medium-Sized Entities), which is a simplified framework based on IFRS for SMEs. There are specific size criteria (balance sheet total, turnover, number of employees) to qualify for GAPSME.

The directors are responsible for ensuring these financial statements are prepared correctly.

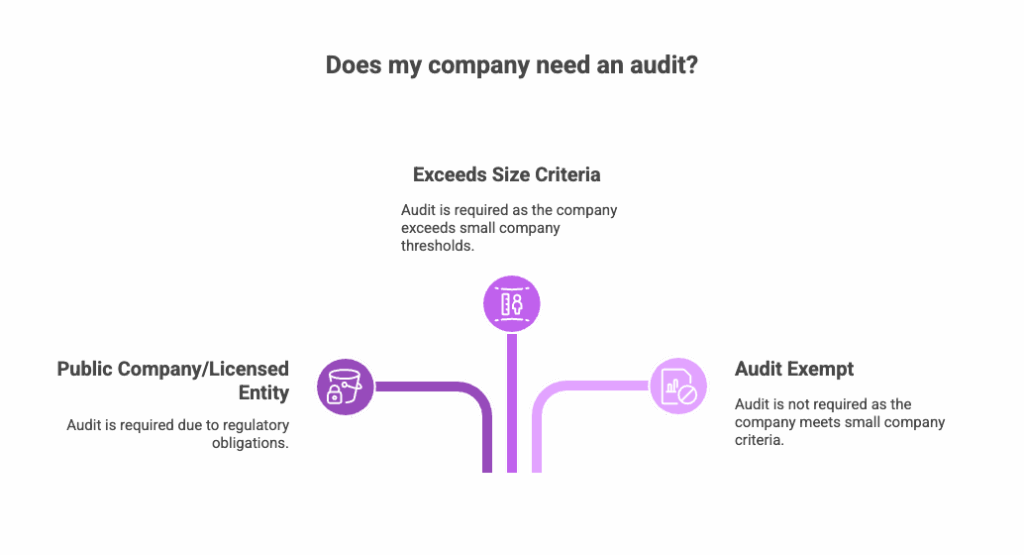

3. The Statutory Audit: Independent Verification (Not Always Mandatory)

Once the annual financial statements are prepared, they may need to be audited by an independent, registered Maltese auditor. An audit provides an external opinion on whether the financial statements give a true and fair view and have been properly prepared.

Is an audit always required for a Maltese company? No. Malta provides audit exemptions for small companies that meet certain criteria. A company qualifies as “small” (and can therefore potentially be exempt from a statutory audit) if, on its balance sheet date, it does not exceed the limits of at least two of the following three criteria:

- Balance Sheet Total: €2,500,000 (this threshold has seen adjustments, with recent proposals to increase it significantly – always verify the current thresholds with the MBR or your advisor). For the purpose of this general guide, we’ll refer to commonly understood past thresholds, but emphasise checking current figures. Let’s assume for example past thresholds like: Balance Sheet Total: €2,560,000; Turnover: €5,120,000; Average number of employees during the financial year: 50. More recent thresholds effective from 2023 (for financial years ending on or after 31 Dec 2022) are Balance Sheet Total: €6,000,000; Turnover: €12,000,000; Average number of employees: 50. For financial years commencing on or after 1 January 2024 and ending on or after 31 December 2024, these thresholds are expected to increase further Balance Sheet Total: €7,500,000; Turnover: €15,000,000; Average number of employees: 50. Crucially, for financial years ending on or after 31 December 2024, the thresholds for a “small company” (and thus audit exemption) are expected to be: Balance Sheet Total: €7.5 million, Net Turnover: €15 million, and Average Employees: 50.

- Net Turnover: €15,000,000 (as per the expected increase for FYE 31/12/2024 onwards).

- Average Number of Employees during the financial year: 50.

Important Considerations for Audit Exemption:

- The company must qualify as “small” for two consecutive accounting periods to benefit from the exemption in the second year (specific rules apply for new companies).

- Certain types of companies (e.g., public companies, licensed financial institutions) are generally not eligible for audit exemption regardless of size.

- Even if exempt, shareholders holding at least 5% of the shares can still request an audit.

- Companies must still prepare full financial statements even if exempt from audit.

If an audit is required: The directors must appoint a registered auditor. The auditor will conduct an independent examination and issue an audit report, which forms part of the annual financial statements filed with the MBR. The initial stages of Malta company setup should involve consideration of potential future audit needs.

4. Filing the Annual Return with the Malta Business Registry (MBR)

Every Maltese company must file an Annual Return with the MBR each year. This is a snapshot of key company information as at the anniversary of its registration.

Content of the Annual Return:

- Company name and registration number.

- Registered office address.

- Details of issued share capital.

- Particulars of directors and company secretary.

- Particulars of shareholders.

- A declaration confirming the company has complied with its obligations.

Filing Deadline:

- The Annual Return must be completed and filed with the MBR within 42 days (6 weeks) of the company’s anniversary of registration.

- Crucial: This deadline is strict. Late filing incurs penalties.

Accompanying Documents (The “Annual Accounts”):

- Along with the Annual Return, companies must also file a copy of their approved annual financial statements (audited, if an audit was required).

- The deadline for filing these financial statements with the MBR is generally:

- For Private Companies: Within 10 months of the financial year-end.

- For Public Companies: Within 7 months of the financial year-end.

- These statements must have been approved by the shareholders in a general meeting.

Failure to file the Annual Return and accounts on time results in escalating late filing penalties levied by the MBR. This is a critical aspect of ongoing Malta company compliance.

5. Filing the Annual Corporate Income Tax Return

Separate from MBR filings, every Maltese company must file an annual Corporate Income Tax Return with the Malta Commissioner for Revenue.

- Content: This return declares the company’s taxable income, allowable deductions, tax credits, and calculates the corporate income tax due (at the standard 35% rate before any shareholder refunds).

- Supporting Financial Statements: The tax return must be accompanied by a copy of the company’s audited financial statements (if an audit was required) or unaudited financial statements (if audit-exempt).

- Filing Deadline: The deadline for filing the tax return is typically nine months after the company’s financial year-end, OR 31st March of the following calendar year, whichever is later. (For example, if the year-end is 31st December 2023, the deadline would be 30th September 2024). Electronic filing can sometimes grant a short extension.

Timely and accurate tax filing is essential to avoid tax penalties and interest.

6. Payment of Annual Fees

- MBR Annual Company Registration Fee: When filing the Annual Return, an annual registration fee is payable to the MBR. The amount of this fee depends on the company’s authorized share capital. (For a company with minimum share capital, this fee is currently around €100, but always check current MBR fee schedules).

- Other Potential Fees: Depending on the company’s activities, other specific industry license fees or regulatory contributions might apply.

The Role of Your Corporate Service Provider (CSP) in Annual Compliance

Managing these diverse annual obligations, especially for businesses with non-resident management or those unfamiliar with Maltese procedures, can be a significant administrative burden. This is where a proactive CSP like Contact Advisory Services Ltd. provides invaluable support:

- Calendar Management: We help you track all critical deadlines for MBR filings, financial statement preparation, and tax returns.

- Preparation of Annual Return: We prepare and submit the Annual Return to the MBR on your behalf.

- Coordination of Financial Statements & Audit: While we don’t perform audits or prepare accounts ourselves, we work closely with your chosen accountants and auditors to ensure financial statements are prepared and audited (if necessary) in time for MBR filing deadlines. We can provide referrals to trusted, independent accounting and audit firms.

- Liaison with Authorities: We act as your intermediary with the MBR and can coordinate with tax advisors for tax return filings.

- Ensuring Good Standing: Our goal is to help your company remain in good legal and financial standing, avoiding penalties and interruptions.

This ongoing support is a crucial extension of our initial Malta company formation services. Many clients choose to retain us for these annual compliance tasks to ensure peace of mind.

Need assistance managing your Maltese company’s annual compliance? Explore our comprehensive corporate services.

Consequences of Non-Compliance

The Maltese authorities take compliance seriously. Failure to meet these annual obligations can lead to:

- Late Filing Penalties: The MBR imposes fixed daily or escalating penalties for late filing of Annual Returns and accounts. Tax authorities also impose penalties for late tax returns and payments.

- Loss of Good Standing: Persistent non-compliance can result in the company losing its “good standing” status, which can affect its ability to conduct business, obtain bank facilities, or enter into contracts.

- Legal Action: Directors can be held personally liable for certain breaches of company law.

- Strike-Off from Register: In cases of prolonged non-compliance, the MBR has the power to strike the company off the register, effectively dissolving it.

Conclusion: Proactive Management for Sustained Success in Malta

Maintaining annual compliance is not merely an administrative chore; it is essential for the legal health, reputation, and continued success of your Maltese company. From accurately keeping books and preparing financial statements to understanding audit requirements and meeting all MBR and tax filing deadlines, a proactive and organized approach is key.

The key annual obligations – the MBR Annual Return (within 42 days of anniversary) accompanied by financial statements (within 7-10 months of year-end), and the annual Corporate Income Tax Return (generally 9 months from year-end) – along with associated fees, form the backbone of your company’s yearly responsibilities.

By understanding these requirements and deadlines, and by leveraging the support of experienced professionals like Contact Advisory Services Ltd., you can navigate the annual compliance landscape in Malta with confidence, ensuring your business remains in good standing and free to focus on its core objectives and growth.

Is your Maltese company approaching its compliance deadlines, or are you looking for reliable support to manage these ongoing obligations?

Contact Contact Advisory Services Ltd. today for expert assistance and peace of mind:

Email: info@contact.com.mt