The Malta Societas Europaea (SE): Your Passport to Simplified Pan-European Business Operations

Operating across multiple European Union member states brings immense opportunity – access to diverse markets, talent pools, and innovation hubs. However, it also often brings significant administrative complexity. Managing separate legal entities in different countries, each with its own company law, compliance requirements, and reporting standards, can quickly become a labyrinthine challenge, draining resources and hindering agility.

Imagine streamlining this complexity. What if you could operate across the EU under a single, unified legal structure, recognized in every member state? What if you could simplify administration, enhance your European corporate identity, and potentially benefit from a strategically advantageous home base like Malta?

Enter the Societas Europaea (SE), often referred to as the “European Company.” This unique legal entity was specifically designed by the EU to overcome the hurdles faced by companies operating across borders. And when established in a pro-business jurisdiction like Malta, the Malta Societas Europaea offers a compelling proposition for ambitious multinational businesses.

But what exactly is a Malta SE? How is it formed? What are the specific requirements, and crucially, is it the right structure for your pan-European business? This guide provides a deep dive into the world of the Malta SE, exploring its niche benefits, formation pathways, and why Malta provides fertile ground for this sophisticated corporate structure.

Demystifying the Societas Europaea (SE): A Truly European Company

Think of it as a company with a “European passport.” An SE registered in one member state (like Malta) can operate through branches in other member states more easily, often avoiding the need to form separate subsidiaries in each country. Its primary objective is to facilitate cross-border activities, including mergers, restructuring, and the management of geographically dispersed operations under one corporate umbrella.

The Societas Europaea (Council Regulation (EC) No 2157/2001) is not just another national company type. It’s a unique, supranational legal form established under EU law, designed to function seamlessly across all European Union (EU) and European Economic Area (EEA) countries.

Key characteristics include:

- EU-Wide Recognition: Governed by EU regulation, supplemented by the national laws of the member state where its registered office is located (e.g., Malta).

- Single Legal Entity: Allows businesses to operate across the EU/EEA under one set of rules and a unified management and reporting system.

- Transferability: An SE can transfer its registered office from one EU/EEA member state to another without liquidation and re-formation, offering unparalleled flexibility (subject to specific procedures).

(Suggested Visual: Infographic explaining the core concept of an SE – “One Company, One Set of Rules (EU + National), Multiple Countries”.)

Why Choose Malta as the Home for Your Societas Europaea?

While the SE is an EU concept, the decision of where to register your SE is critical. Malta offers a compelling blend of advantages that make it an attractive jurisdiction for establishing a Malta Societas Europaea:

- Strategic Location: Situated in the heart of the Mediterranean, Malta provides excellent connectivity to Europe, North Africa, and the Middle East.

- Pro-Business Environment: Malta is renowned for its supportive government policies, accessible regulators (like the Malta Business Registry – MBR), and a proactive approach to attracting international business.

- Favourable Tax System: Malta’s full imputation corporate tax system, coupled with potential tax refunds for eligible shareholders and an extensive network of Double Taxation Treaties (over 70), can offer significant tax efficiencies for multinational operations structured through a Malta SE. (Professional tax advice is essential here).

- EU Membership & Eurozone: Full EU membership guarantees access to the single market, while Eurozone membership simplifies financial transactions across much of Europe.

- Skilled, English-Speaking Workforce: English is an official language, and Malta boasts a highly educated, multilingual workforce, particularly strong in finance, legal, tech, and corporate services.

- Robust Legal & Regulatory Framework: Maltese company law is sophisticated, EU-compliant, and provides a stable and familiar framework for international companies. Malta has specific provisions implementing the SE Regulation.

- Expertise in Corporate Services: Malta has a deep pool of experienced professionals – lawyers, accountants, and company service providers like Contact Advisory Services Ltd. – adept at handling complex structures like the SE.

Choosing Malta as the registered office for your SE means combining the inherent benefits of the European Company structure with the specific advantages of Malta’s business ecosystem, potentially creating a powerful operational and financial synergy for your pan-European activities. This strategic choice is a core part of effective Malta company formation for large, cross-border entities.

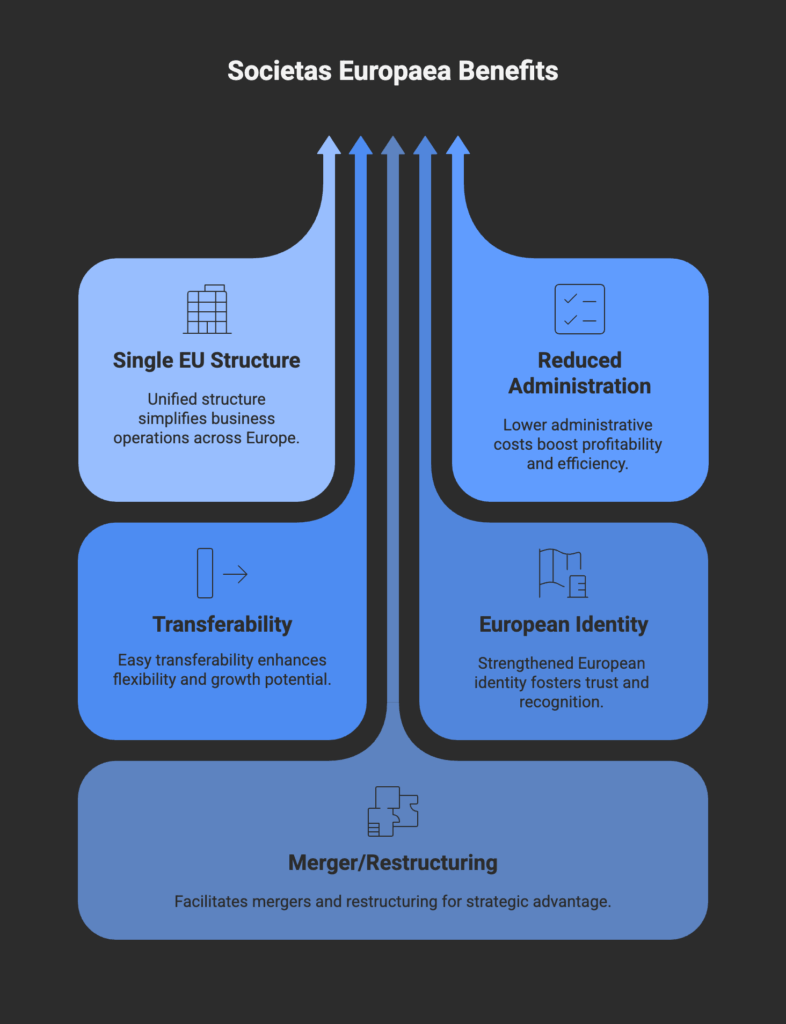

Unlocking Efficiency: Key Features & Benefits of a Malta SE

Opting for a Malta SE structure brings tangible benefits, particularly for businesses grappling with multi-jurisdictional complexities:

- Unified Operations & Simplified Administration: Operate across the EU/EEA under a single corporate identity and potentially consolidated management. This drastically reduces the administrative burden associated with managing multiple national subsidiaries, leading to cost savings and increased efficiency.

- Enhanced Cross-Border Mobility: The ability to transfer the SE’s registered office to another EU/EEA member state without dissolving the company offers exceptional strategic flexibility for restructuring or relocating headquarters in response to market changes.

- Strong European Corporate Image: Adopting the SE title signals a clear pan-European commitment and identity, enhancing credibility and brand recognition across the continent with clients, partners, and potential investors.

- Facilitation of Cross-Border Mergers & Restructuring: The SE framework provides specific mechanisms for companies from different member states to merge or form holding companies/subsidiaries more easily than using purely national laws.

- Potential for Streamlined Reporting: While subject to Maltese and EU rules, operating as a single entity can simplify group reporting compared to managing disparate subsidiaries with varying reporting requirements.

- Access to Malta’s Tax Advantages: As mentioned, structuring through a Malta SE allows the entity potentially to benefit from Malta’s attractive corporate tax environment for its worldwide income, subject to specific conditions and tax advice.

Pathways to Creation: How Can a Malta SE Be Formed?

Unlike standard national companies, a Societas Europaea cannot simply be incorporated from scratch by individuals. It must be formed by existing companies through specific cross-border mechanisms defined in the EU Regulation. The primary methods include:

- Merger Formation: Companies from at least two different EU/EEA member states can merge to form an SE. This can be a merger by acquisition (one company absorbs others) or a merger by formation of a new company (the merging companies cease to exist, and a new SE is formed).

- Holding SE Formation: Two or more public or private limited companies from at least two different member states (or existing SEs) can promote the formation of a Holding SE by contributing shares, without the promoting companies being dissolved.

- Subsidiary SE Formation: Companies or firms (as defined by the Treaty on the Functioning of the EU) from at least two different member states can form a subsidiary SE by subscribing for its shares.

- Conversion of an Existing PLC: A Public Limited Company (PLC) registered in a member state (like Malta) for at least two years, which has had a subsidiary in another member state for that period, can convert into an SE without liquidation.

Critically, each formation method requires a cross-border element, involving companies or activities in at least two different EU/EEA member states.

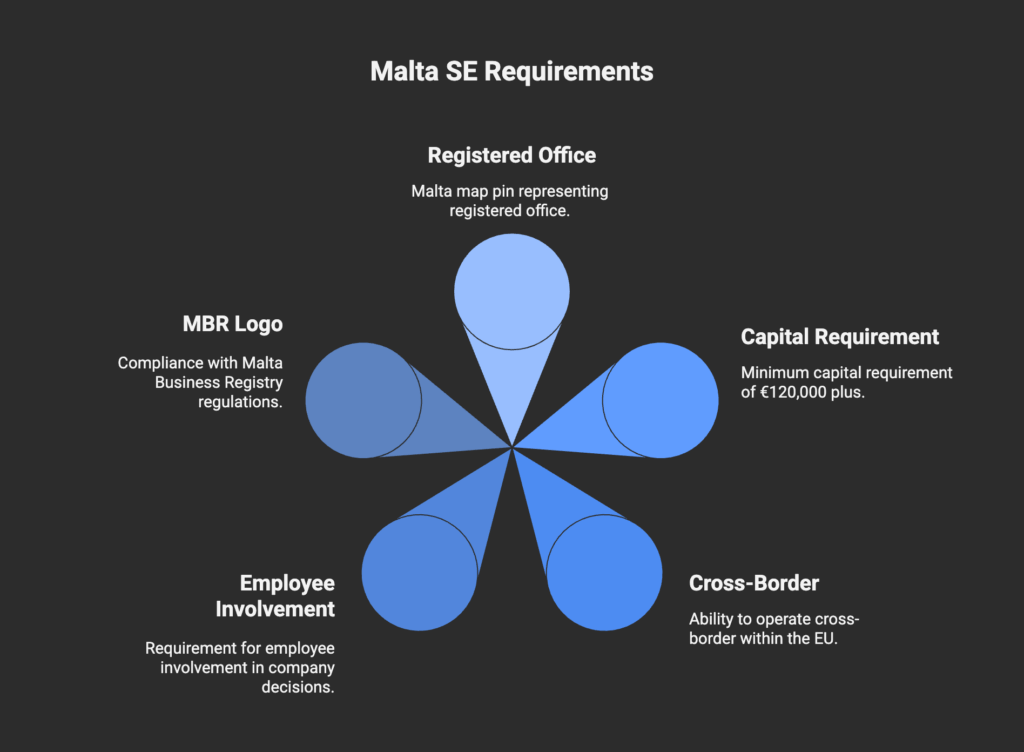

The Blueprint: Core Requirements for Establishing a Malta SE

Forming a Malta Societas Europaea involves meeting specific, often demanding, requirements:

- Registered Office in Malta: The SE must have its registered office located physically in Malta. This address dictates that Maltese law supplements the EU Regulation governing the SE.

- Minimum Subscribed Share Capital: An SE must have a minimum subscribed share capital of €120,000 (or the equivalent in another major currency). The rules regarding paid-up capital generally follow the national rules for PLCs in the member state of registration (in Malta, typically 25% paid-up for PLCs, which would translate to approx. €30,000 for an SE, though this needs careful verification based on the specific formation). This high capital requirement clearly positions the SE for substantial undertakings.

- Cross-Border Element: As highlighted in the formation methods, the establishment must involve entities or activities spanning at least two EU/EEA member states.

- Statutes & Objects: Like any company, the SE needs statutes (similar to Memorandum & Articles) defining its name (which must include “SE”), objects, capital, governance structure, etc., compliant with both the SE Regulation and Maltese law.

- Registration with MBR: The SE must be registered with the Malta Business Registry (MBR), similar to other Maltese companies, once all formation requirements are met.

- Employee Involvement Arrangements: This is a unique and complex requirement specific to the SE. Before registration can be completed, arrangements must be concluded regarding the involvement of employees in the SE’s affairs (e.g., information, consultation, potential board-level participation). This involves negotiations between the management of the participating companies and an employee representative body (Special Negotiating Body – SNB). Failure to reach an agreement triggers standard statutory rules.

Employee Involvement: The SE’s Unique Consideration

The provisions on employee involvement are a cornerstone of the SE Regulation and often the most complex aspect of formation. The aim is to ensure employees’ rights regarding information, consultation, and potentially participation (e.g., board representation) are maintained or enhanced when companies create an SE, especially through cross-border mergers or conversions where different national systems previously applied.

- Negotiation Process: Management must initiate negotiations with employee representatives (forming an SNB) from all involved companies across the relevant member states.

- Agreement or Standard Rules: The goal is to reach a bespoke agreement tailored to the SE. If no agreement is reached within a specific timeframe (typically 6 months, extendable to 12), ‘standard rules’ defined in the EU Directive (and transposed into Maltese law) automatically apply. These standard rules often provide significant participation rights if certain thresholds of employee board-level participation existed in the founding companies.

- Complexity: This process requires careful management, legal expertise in both corporate and employment law across multiple jurisdictions, and skilled negotiation. It’s a significant factor distinguishing the SE setup from standard Malta company registration.

Navigating the employee involvement aspect successfully is critical for the timely and compliant formation of a Malta SE.

The Ideal Candidate: Who Should Consider a Malta SE?

The Malta SE is a sophisticated structure, not a one-size-fits-all solution. It is best suited for:

- Large Multinational Companies: Businesses already operating subsidiaries or branches across multiple EU/EEA states that want to unify their structure, simplify administration, and project a strong European identity.

- Companies Undergoing Cross-Border Mergers: The SE provides a dedicated legal framework to facilitate complex mergers between companies located in different member states.

- Businesses Seeking Maximum Mobility: Companies that anticipate needing to relocate their headquarters within the EU/EEA without dissolving the legal entity will value the SE’s unique transferability feature.

- Companies Aiming for a Prestigious Pan-European Profile: The “SE” suffix carries weight and signals a significant, integrated European operation, potentially boosting credibility with international partners and stakeholders.

- Groups Planning Complex Restructuring: The various formation methods (holding SE, subsidiary SE) offer tools for sophisticated cross-border group reorganizations.

Conversely, the SE is generally not suitable for startups, SMEs with primarily domestic operations, or businesses unwilling or unable to meet the high share capital requirement and navigate the complexities of employee involvement negotiations. For these businesses, a standard Malta Ltd or potentially a PLC might be more appropriate initial steps in their Malta company formation journey.

Navigating the Formation Process in Malta

The exact steps for forming a Malta Societas Europaea depend heavily on the chosen method (merger, holding, subsidiary, conversion). However, a general overview involves:

- Strategic Decision & Planning: Thoroughly evaluating the suitability of the SE structure and choosing the appropriate formation method.

- Drafting Key Documents: Preparing the draft terms of merger/conversion, the SE’s statutes, reports justifying the formation, etc.

- Employee Involvement Negotiations: Initiating and concluding the mandatory negotiations with the Special Negotiating Body (SNB). This can be time-consuming.

- Shareholder Approvals: Obtaining necessary approvals from the shareholders of the participating companies.

- Regulatory Approvals & Pre-Merger Certificates: Securing approvals from relevant national authorities (including potentially competition authorities) and obtaining necessary certificates confirming completion of pre-formation procedures in other involved member states.

- Registration with Malta Business Registry (MBR): Submitting all required documentation, including evidence of the concluded employee involvement arrangements and the high minimum share capital being subscribed, to the MBR for final registration.

- Publication: Announcing the registration of the SE in the relevant official gazettes.

Given the inherent cross-border nature and specific requirements like employee involvement, forming a Malta SE is significantly more complex than setting up a standard Ltd or PLC. It invariably requires expert legal, tax, and corporate advisory support spanning multiple jurisdictions.

How Contact Advisory Services Can Be Your Guide

The path to establishing a Malta Societas Europaea demands specialized expertise and meticulous coordination. At Contact Advisory Services Ltd., an MFSA Authorised Company Services Provider, we possess the knowledge and experience to guide businesses through this intricate process.

Our team understands the nuances of both the EU SE Regulation and Malta’s implementing legislation. We can assist with:

- Feasibility Assessment: Helping you determine if the SE structure truly aligns with your strategic objectives compared to other Malta corporate structures.

- Formation Method Guidance: Advising on the most appropriate method (merger, holding, subsidiary, conversion) for your situation.

- Project Management: Coordinating the complex legal, regulatory, and administrative steps across involved jurisdictions.

- Documentation Support: Assisting in the preparation and review of essential documents like the SE statutes and registration forms.

- Liaison with MBR & Authorities: Managing communications and submissions with the Malta Business Registry and other relevant bodies.

- Connecting with Specialists: Facilitating introductions to legal experts specializing in cross-border employment law for navigating employee involvement requirements.

- Post-Formation Services: Providing ongoing registered office, company secretarial, and compliance support tailored to the needs of an SE operating from Malta.

We offer comprehensive support for complex Malta company formation needs, ensuring your pan-European structure is established efficiently and compliantly.

Learn more about our full range of corporate services here

Conclusion: The Malta SE – A Strategic Tool for Unified European Operations

The Malta Societas Europaea (SE) stands apart as a unique and powerful tool for businesses genuinely committed to integrated, pan-European operations. It offers the unparalleled benefit of a single legal identity recognized across the EU/EEA, simplifying administration, enhancing cross-border mobility, and projecting a strong European corporate image.

However, its significant minimum share capital requirement (€120,000) and the mandatory, often complex, process of negotiating employee involvement arrangements clearly position it as a structure for substantial, multinational undertakings, particularly those involved in cross-border mergers or restructurings. It’s not a standard choice but a strategic one.

Choosing Malta as the home for your SE combines these unique structural advantages with a favourable tax environment, a pro-business ecosystem, and deep expertise in international corporate services.

If your organization is grappling with the complexities of managing multiple European entities and seeks a unified, efficient, and prestigious pan-European structure, the Malta SE deserves serious consideration.

Is the Malta Societas Europaea the right strategic move for your pan-European vision? Get in touch with Contact Advisory Services Ltd. to discuss the feasibility and navigate the formation process with confidence.

Email: info@contact.com.mt