From a Corporate Service Provider’s Desk: The Malta Corporate Bank Account. Step-by-Step Guide

You’ve successfully navigated the crucial first phase: your new Malta company is officially registered!

The Certificate of Registration from the Malta Business Registry (MBR) is in hand – a significant milestone. As a Corporate Services provider at Contact Advisory Services Ltd., we share in that initial excitement with our clients every day. However, we also know what often comes next: the often-underestimated hurdle of opening a Malta corporate bank account.

From our vantage point, assisting countless businesses establish their Maltese operations, we have seen firsthand how this seemingly straightforward step can become a source of frustration and delay. “Why is it taking so long?” and “Why do they need another document?” are questions we hear frequently. The reality is, in today’s highly regulated financial world, establishing banking for a new corporate entity, especially one with international ties, is a detailed process demanding thoroughness and patience.

But it’s not an insurmountable obstacle. With the right preparation, understanding, and a bit of insider knowledge, you can navigate this process much more smoothly. Our aim with this guide is to pull back the curtain, share insights gleaned from years of experience, and provide you with a practical, step-by-step approach to successfully opening a business bank account in Malta for your newly formed company. Let’s get your financial foundations firmly in place.

Why Banks Ask “So Many Questions”: Understanding the Current Banking Climate

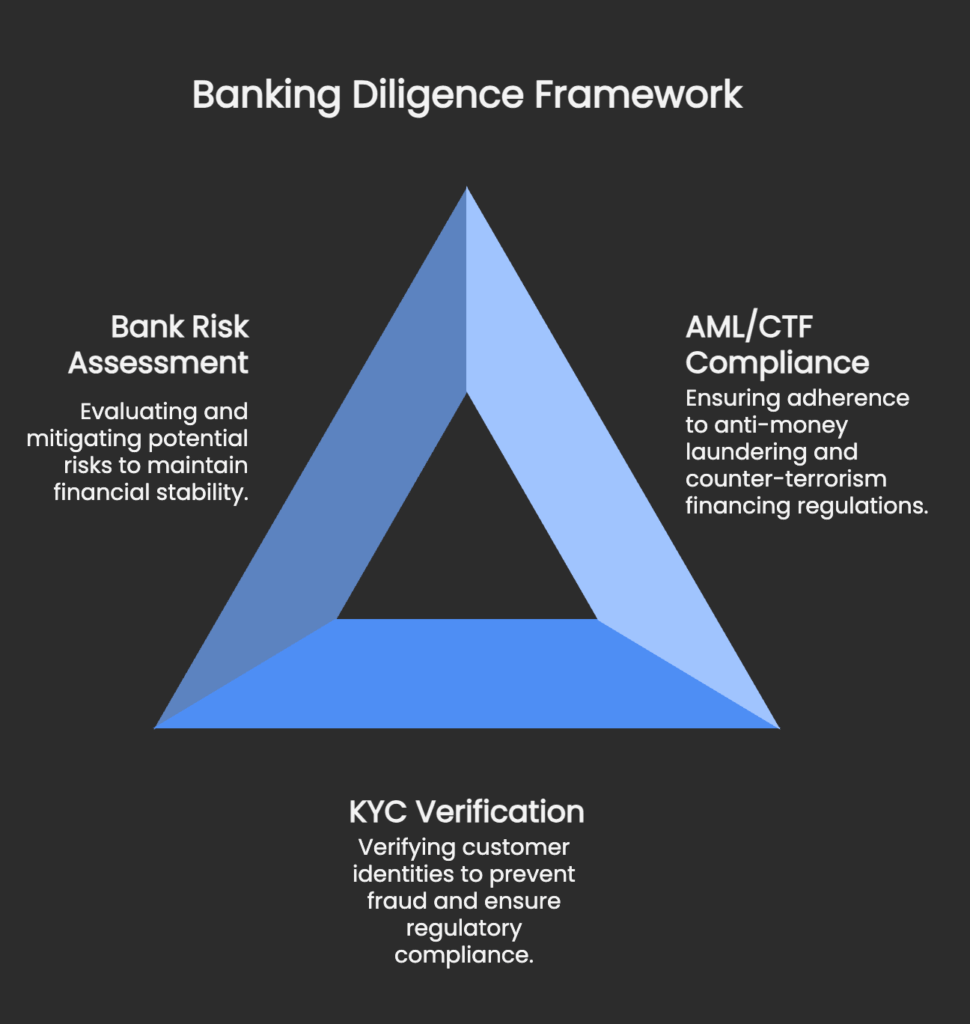

Before we jump into the “how-to,” it’s vital to understand the “why.” Asa a corporate services provider, a key part of our role during the Malta company setup is managing expectations. Banks in Malta, like reputable financial institutions globally, operate under immense regulatory pressure, primarily concerning Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF). They are the frontline guardians against financial crime.

This means their Know Your Customer (KYC) and due diligence processes are necessarily stringent. They must understand:

- Who you are: The identity and background of the company’s directors, shareholders, and especially the Ultimate Beneficial Owners (UBOs).

- What your business does: The nature of your operations, your target markets, and your expected transaction patterns.

- Where the money comes from (and goes): The source of your initial capital and ongoing funds, and the geographical scope of your payments.

Every document requested, every question asked, is part of this essential risk assessment. It’s not personal; it’s procedural and legally mandated. Approaching this with an understanding of their obligations can make the entire interaction more collaborative.

Choosing Your Banking Partner in Malta: A Strategic Decision

Not all banks are the same, and what works for one company might not suit another. We always advise clients to consider a few options, as risk appetites and service offerings vary:

- Traditional Maltese Banks: These institutions have a strong local presence and offer a full range of services. They are often thorough and can be a good fit for businesses with significant local operations. From experience, their onboarding for international clients can be very detailed.

- International Banks with a Malta Presence: Global banking names often cater well to larger corporates or specific niches, leveraging their international networks. Their compliance standards are typically very high, reflecting group-wide policies.

- Electronic Money Institutions (EMIs) / Payment Service Providers (PSPs): These are increasingly popular, especially for businesses focused on international trade or digital services. They often offer faster onboarding, slick online platforms, and competitive international payment fees. However, they might not provide the full spectrum of traditional banking services (like credit facilities). We always verify their licensing and fund protection mechanisms for clients.

Our Approach at Contact Advisory Services: We don’t just send you a list of banks. We discuss your business model, transaction needs, and UBO profiles to help identify institutions whose criteria you’re more likely to meet. This pre-selection can save considerable time and effort. As part of our comprehensive Malta company formation services, bank introduction and application support are key.

The Journey: A Manager’s Step-by-Step Guide to Account Opening

Here’s how the process typically unfolds, based on our experience guiding clients:

Step 1: Careful Preparation – Your Foundation for Success

This is where, as a Corporate Services Provider, we place the most emphasis. Get this right, and everything else flows more smoothly.

- Complete Company Registration: Ensure your company is fully registered with the MBR. Banks will need the official documentation.

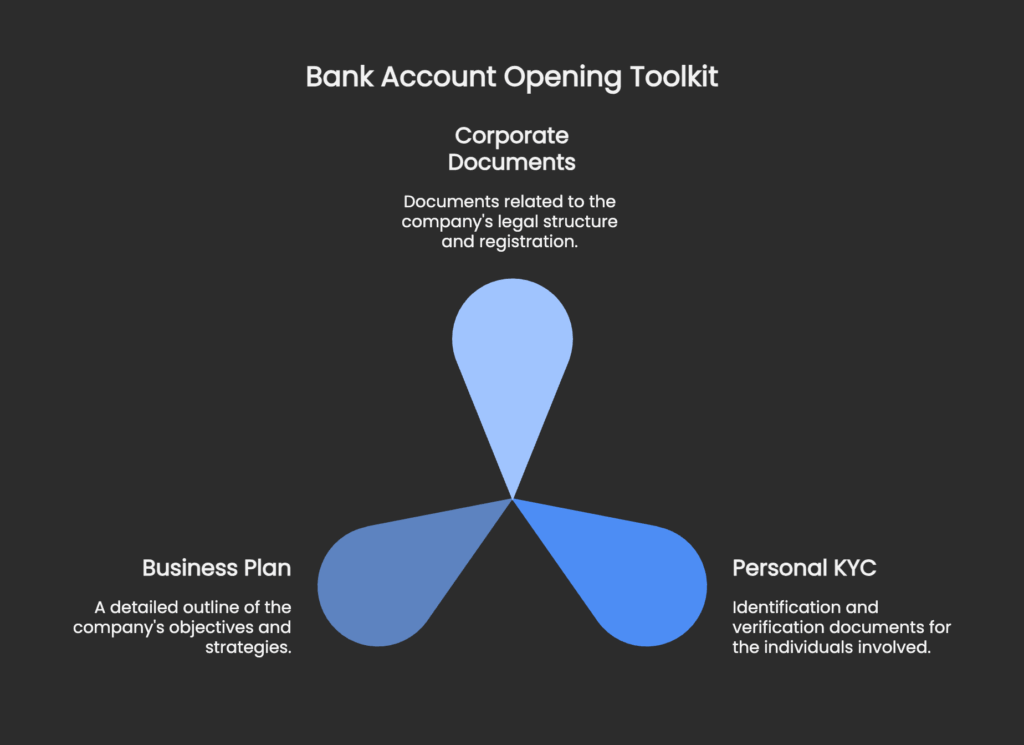

- Gather All Corporate Documents: This includes your Certificate of Registration, Memorandum & Articles of Association, and a recent company search showing directors and shareholders. We collate these for you.

- Prepare Personal KYC for All Involved: This is critical for directors, shareholders (typically holding 10-25% or more), and all UBOs, regardless of their shareholding percentage. This usually includes:

- Certified Passport Copies: The certification often needs to be done by a notary public, lawyer, or sometimes an embassy, and be recent. Banks have specific requirements.

- Proof of Residential Address: A recent (usually less than 3 months old) utility bill or bank statement. Again, certification might be needed.

- Detailed CVs: Outlining professional background.

- Bank Reference Letters: From personal banks, confirming a satisfactory relationship.

- Source of Funds/Wealth Declaration & Evidence: This is increasingly vital. Be prepared to clearly explain and document where the capital for the business is coming from and the general wealth of the UBOs. This might involve salary slips, property sale agreements, investment portfolios, etc. We often help clients prepare this narrative coherently.

- Craft a Clear Business Plan: This doesn’t need to be a 100-page novel, but it must clearly articulate:

- The nature of the business.

- Target market(s).

- Expected income streams and payment flows (volume, geography of clients/suppliers).

- The specific need for a Malta bank account.

- Brief background of the key people involved.

Step 2: Strategic Bank Selection & Initial Engagement

With your documentation pack substantially ready, we then assist with:

- Shortlisting Suitable Banks/EMIs: Based on your profile and our knowledge of the market.

- Making Preliminary Enquiries (Where Appropriate): Sometimes, a no-names preliminary discussion about the business type can gauge a bank’s initial appetite before a full application is submitted.

- Completing Bank Application Forms: These can be lengthy and detailed. Accuracy and consistency with your supporting documents are crucial. We often review these meticulously with clients.

Step 3: The Bank’s Due Diligence – Navigating the Scrutiny

Once submitted, your application enters the bank’s internal review process.

- Compliance Review: The bank’s compliance team will scrutinize every detail.

- Requests for Information (RFIs): Expect these. It’s normal. They might ask for clarification on a transaction, more detail on a UBO’s source of wealth, or an updated document. Our Role: We act as the intermediary, helping you understand the request and formulate a clear, prompt response. Delays here significantly prolong the process. I’ve seen applications stall for weeks due to slow RFI responses.

- Patience is Key: This phase can take from a few weeks to several months. Factors include bank workload, application complexity, and the speed of international information verification if UBOs are in various jurisdictions.

Step 4: The Green Light – Account Approval & Activation

- Approval Notification: The best news! The bank confirms approval.

- Account Details Provided: You’ll receive your IBAN, BIC/SWIFT, and online banking credentials.

- Initial Deposit (if required): Some banks require a small initial deposit to fully activate the account (separate from your share capital).

- Operational Readiness: Your Malta company now has the financial lifeline it needs to operate.

From our experience, a well-prepared application managed by professionals who understand bank expectations significantly reduces the likelihood of outright rejection and can expedite the approval process, though patience is always required.

Pro Tips from a Corporate Services Provider for a Smoother Experience

- Full Transparency: Don’t try to hide or obscure information, especially regarding UBOs or the nature of the business. It will likely come out and will damage credibility.

- Substance in Malta: Clearly demonstrate a genuine reason for your company to be in Malta and to bank there. If you have local staff, an office, or Maltese clients/suppliers, highlight this.

- Keep it Simple (if possible): Overly complex group structures with multiple layers of corporate shareholders across various offshore jurisdictions will inevitably lead to more questions and longer processing times.

- Professional Presentation: Ensure all documents are clear, legible, and professionally presented. A messy, incomplete application creates a poor first impression.

- One Point of Contact: Designate one person (often us, your CSP) to liaise with the bank. This avoids confusion and ensures consistent communication.

- Understand the “Why”: When a bank asks for something, try to understand why they need it from a risk/compliance perspective. It helps in providing the right information.

One common anecdote we share with clients involves the “Source of Wealth” declaration. Many find it intrusive, but banks are legally required to understand that the funds are legitimate. We work with clients to present this information factually and backed by evidence, turning a potential point of friction into a demonstration of transparency.

How Contact Advisory Services Ltd. Facilitates This Critical Step

As your dedicated Corporate Services Provider in Malta, our support doesn’t stop once your company is registered. Assisting with the opening of a Malta business bank account is a core part of ensuring your venture gets off the ground successfully. We leverage our experience by:

- Understanding Bank Appetites: We maintain insights into which banks are generally more receptive to certain business profiles or client nationalities.

- Document Preparation & Review: We guide you on precisely what documents are needed and review them for completeness and compliance with bank standards before submission. This pre-vetting is invaluable.

- Application Form Assistance: We help you navigate the intricate details of bank application forms.

- Professional Introductions: Where possible, we make formal introductions to banking relationship managers we work with.

- Acting as Intermediary: We manage communication with the bank, field queries, and keep you updated, allowing you to focus on your business.

While the final decision to open an account always rests with the bank, our structured approach and experience significantly enhance the quality of your application and the efficiency of the process. This is a key benefit of choosing a CSP that offers holistic support beyond just the initial Malta company registration.

Conclusion: Your Banking Gateway to Maltese Business Success

Opening a corporate bank account in Malta is an indispensable step for any new company, yet it’s one that often requires more diligence and patience than many entrepreneurs anticipate. The global focus on financial transparency and AML/CTF compliance means banks are necessarily thorough in their assessments.

The key to success lies in meticulous preparation, full transparency, a clear presentation of your business case, and a patient, cooperative approach when responding to bank queries. Understanding the bank’s perspective and regulatory obligations can transform a potentially frustrating process into a manageable one.

As your experienced Corporate Services Provider at Contact Advisory Services Ltd., our team are here to guide you through every step, from the initial documentation gathering to liaising with the banks on your behalf. We aim to demystify the process, streamline your application, and help you secure the vital banking facilities your new Malta company needs to operate and grow.

Ready to get started with your Malta company and navigate the bank account opening process with expert support?

Contact Contact Advisory Services Ltd. today for a comprehensive consultation:

Email: info@contact.com.mt