Beyond the Brass Plate: Demonstrating Genuine Economic Substance for Your Maltese Company (Crucial for Tax Benefits)

Malta’s strategic position within the EU and its attractive corporate tax system have long made it a favoured jurisdiction for international businesses. Companies undertaking Malta company formation often look to benefit from its efficient tax framework, including potential shareholder refunds and an extensive double taxation treaty network. However, in today’s global tax landscape, shaped by initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project and EU anti-tax avoidance directives, merely incorporating a company in Malta is no longer sufficient to access these benefits robustly. The key now lies in demonstrating genuine economic substance on the island.

What exactly does “substance” mean in the Maltese context? Why has it become so critical, especially for tax purposes? How can your Maltese company proactively demonstrate that it has sufficient physical presence, operational activity, and decision-making capabilities within Malta to satisfy both local and international expectations? Failing to address Malta substance requirements adequately can lead to challenges from tax authorities, denial of treaty benefits, and ultimately undermine the intended advantages of your Maltese structure.

As corporate services consultants at Contact Advisory Services Ltd., guiding clients on establishing and maintaining appropriate substance is an increasingly vital part of our advisory. This article will delve into the core principles of economic substance in Malta, explain why it’s non-negotiable for leveraging tax benefits, and provide practical insights on how to effectively demonstrate genuine presence and operational reality for your Maltese company.

The Global Shift: Why “Substance Over Form” is the New Norm

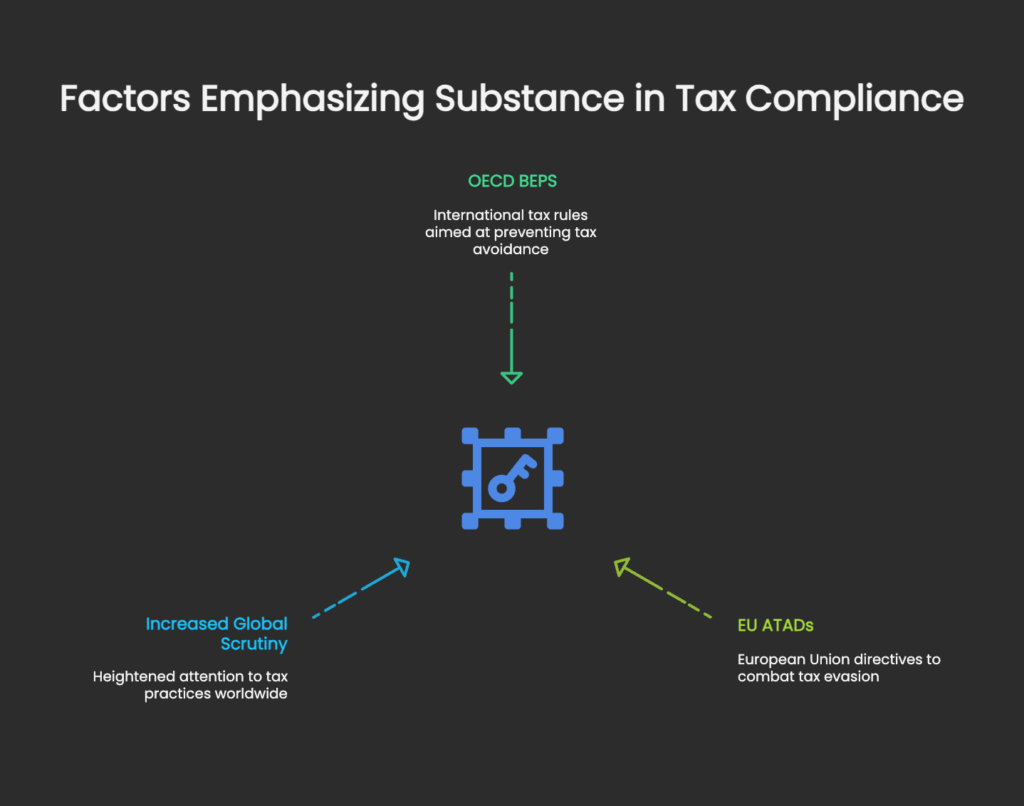

The international tax environment has undergone a seismic shift in recent years. The focus has moved decisively from purely legal “form” (i.e., having a registered company) to “substance” (i.e., demonstrating real economic activity and presence). Initiatives like:

- OECD/G20 BEPS Project: Specifically targets artificial profit shifting and the misuse of tax treaties by entities lacking genuine substance in a jurisdiction.

- EU Anti-Tax Avoidance Directives (ATAD I, II & III – “Unshell Directive” proposal): Implement measures to counter aggressive tax planning, including rules on controlled foreign companies (CFCs), interest limitation, hybrid mismatches, and proposing minimum substance indicators for “shell” entities.

- Increased Scrutiny from Tax Authorities Globally: Tax administrations worldwide are more aggressively challenging structures that appear to lack commercial rationale or genuine connection to the jurisdiction where profits are booked.

The clear message is: tax benefits should align with where real economic value is created. Companies cannot simply be “letterbox” entities or “brass plates” devoid of actual operations and expect to enjoy the full advantages of a particular tax regime, including Malta’s.

Defining Substance in the Maltese Context: More Than Just an Address

While there isn’t a single, exhaustive legal definition of “substance” that fits every scenario, it generally refers to a company having sufficient tangible presence and operational reality in Malta commensurate with the income it generates and the business activities it purports to undertake. Key indicators often considered by the Maltese tax authorities (and foreign tax authorities looking at Maltese entities) include:

- Premises: Having adequate physical office space in Malta suitable for the company’s activities. This doesn’t necessarily mean a vast, independent office for every company, but it should be more than just a registered office address provided by a CSP if significant operations are claimed.

- Personnel/Employees: Employing an adequate number of qualified personnel in Malta, physically present and carrying out core income-generating activities (CIGAs). The number and qualifications should be proportionate to the business.

- Decision-Making (Management & Control): Demonstrating that strategic and key management decisions concerning the company’s core activities are genuinely taken in and from Malta. This often involves having Malta-resident directors actively involved in governance and operational oversight.

- Expenditure: Incurring adequate operational expenditure in Malta related to the company’s core activities.

- Assets: Holding relevant assets (tangible or intangible) in Malta that are used in the business.

The level of substance required is not one-size-fits-all. It’s a qualitative assessment based on the specific facts and circumstances of each company, its industry, its scale of operations, and the nature of the income it earns. A holding company, for instance, might have different substance indicators than an active trading or manufacturing company.

This concept of substance is crucial for any business that has completed its Malta company registration and intends to operate effectively.

Why Substance Matters Critically for Your Maltese Company’s Tax Position

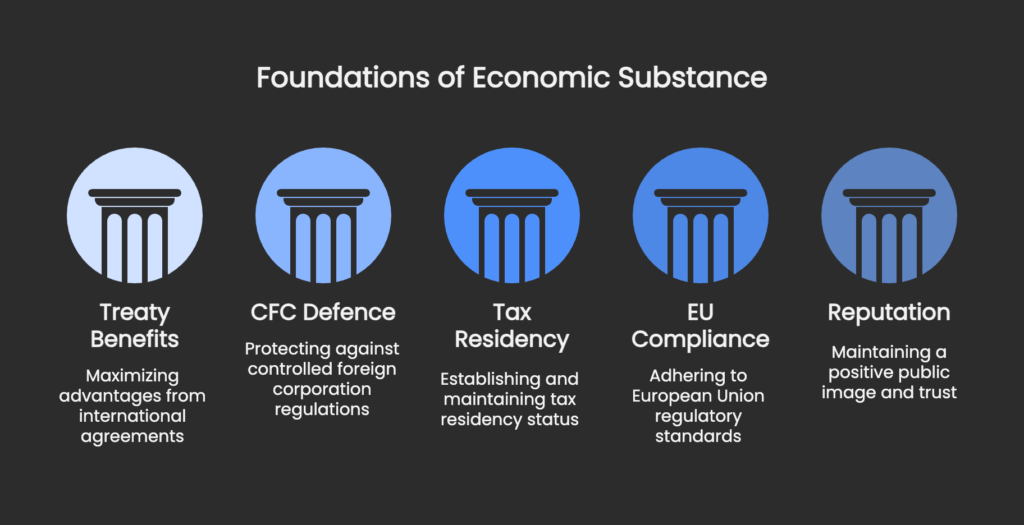

Demonstrating adequate economic substance in Malta is paramount for several tax-related reasons:

- Accessing Double Taxation Treaty Benefits: Most of Malta’s DTTs contain provisions (often in the preamble or specific articles like the Principal Purpose Test – PPT) designed to prevent treaty abuse. Foreign tax authorities are increasingly likely to deny treaty benefits (e.g., reduced withholding taxes on payments to a Maltese company) if they perceive the Maltese entity as lacking sufficient substance and merely being a conduit to access the treaty.

- Defending Against CFC Rules: Many countries have Controlled Foreign Company (CFC) rules that can attribute the income of a low-taxed foreign subsidiary back to its parent company if the subsidiary lacks substance and genuine economic activity. Robust substance in Malta helps defend against such CFC implications.

- Supporting Maltese Tax Residency Claims: While legal incorporation establishes Maltese residency, effective management and control exercised in Malta (evidenced by local decision-making and substance) solidifies this claim, especially in the eyes of foreign tax authorities.

- Qualifying for Certain Maltese Tax Benefits/Regimes: While Malta’s tax refund system for shareholders doesn’t explicitly make refunds conditional on the company’s substance in the same way some specific regimes might, the overall legitimacy and auditability of the company’s tax position (which is a prerequisite for refunds) is strengthened by demonstrable substance.

- Addressing EU “Unshell Directive” (ATAD III) Proposals: Although still evolving, the EU’s proposed “Unshell Directive” aims to identify entities with minimal substance (“shell companies”) and deny them tax advantages. Proactively establishing genuine substance aligns with the direction of these EU initiatives.

- Reputational Integrity: Operating with genuine substance enhances the company’s reputation with banks, suppliers, clients, and regulatory authorities, fostering trust and smoother business relationships.

In essence, substance is the bedrock upon which the tax efficiency of a Malta business setup for international operations is built.

Practical Steps: How to Build and Demonstrate Substance in Malta

Building and evidencing substance is an ongoing process, not a one-time fix. Here are practical areas to focus on:

1. Physical Premises:

- Beyond the Registered Office: While a registered office (often provided by a CSP like Contact Advisory Services Ltd.) is a legal requirement, for companies claiming significant operational activity, relying solely on this might not be enough for substance.

- Options:

- Leasing Dedicated Office Space: The most robust option for companies with local staff and operations.

- Serviced Offices/Co-Working Spaces: Can provide a flexible and cost-effective solution, offering a physical workspace, meeting rooms, and professional address, demonstrating more than just a mailing address.

- Substantiated Shared Office Space: Some CSPs may offer dedicated desk space or segregated office areas within their premises that can contribute to substance if genuinely used for the company’s operations.

- Key: The space should be adequate and appropriate for the nature and scale of the business conducted in Malta.

2. Personnel & Employees:

- Local Hiring: Employing qualified staff resident in Malta who are directly involved in the company’s core income-generating activities is a strong indicator of substance.

- Number & Qualifications: The number of employees and their skill sets should be proportionate to the business. A company claiming substantial trading profits with no local employees conducting that trade will raise red flags.

- Outsourcing vs. Employment: While certain non-core functions can be outsourced, core activities should ideally be performed by employees or at least demonstrably managed and controlled from Malta by key personnel.

3. Management and Control (Decision-Making in Malta):

- Malta-Resident Directors: Appointing qualified directors who are resident in Malta and actively participate in the company’s strategic and operational decision-making is crucial.

- Board Meetings in Malta: Holding regular board meetings in Malta where substantive decisions are discussed, deliberated, and minuted is vital. These should not be mere rubber-stamping exercises.

- Documented Decisions: Keep detailed minutes of board meetings evidencing that key decisions are taken in Malta.

- Active Involvement: Directors should have the necessary expertise and authority to make decisions and should demonstrably exercise that authority from Malta. Simply having nominee directors with no real involvement is insufficient.

4. Operational Expenditure in Malta:

- Incurring operational expenses in Malta proportionate to the business activity (e.g., salaries for local staff, rent for office space, local professional fees, utilities) demonstrates a genuine economic footprint.

5. Bank Accounts & Financial Management:

- Operating a primary corporate bank account in Malta through which significant business transactions flow can contribute to demonstrating local financial management.

6. Business Rationale & Commercial Justification:

- Clearly articulate the commercial reasons for establishing and operating the company in Malta. The structure should make business sense beyond just tax considerations.

Actionable Tip: Substance is not a checklist to be ticked off mechanically. It’s about creating a coherent picture of genuine economic activity and decision-making taking place in Malta, relevant to the income the company earns. Document everything meticulously.

The Role of Your Corporate Service Provider in Building Substance

While the responsibility for substance ultimately lies with the company and its management, a knowledgeable CSP like Contact Advisory Services Ltd. can play a vital supporting role, especially during the initial phases of your Malta company incorporation and ongoing operations:

- Advisory on Substance Requirements: We can explain the principles of substance and discuss how they might apply to your specific business model and industry.

- Assistance with Physical Presence: We can help you explore options for physical office space, from serviced offices to potentially leasing your own premises, leveraging our local network.

- Sourcing Local Directors/Personnel: We can assist in identifying and recruiting qualified Malta-resident individuals for directorship or employment roles, should you require them.

- Company Secretarial Support for Governance: Ensuring board meetings are properly convened, minuted (reflecting decisions made in Malta), and statutory records are maintained contributes to good governance, which supports substance.

- Introduction to Local Professionals: We can connect you with local accountants, auditors, and legal advisors who can provide specialized services related to maintaining and evidencing substance.

- Ensuring Basic Compliance: While not substance itself, ensuring your company meets all its fundamental MBR and tax filing obligations is a prerequisite for any serious business presence.

We work with clients to help them understand what might be expected and to connect them with resources that can help build a defensible substance position. For an overview of initial setup requirements, please see our Malta company formation guide.

Substance for Specific Company Types (e.g., Holding Companies)

The substance requirements can differ based on the company’s function:

- Trading Companies: Generally expected to have more tangible substance – office, employees conducting trade, local expenditure.

- Holding Companies: Substance requirements might focus more on demonstrating that strategic decisions regarding the holding and management of investments are made in Malta by qualified directors. This might involve regular board meetings in Malta to review investment performance, approve acquisitions/disposals, and manage financing. Having personnel with relevant financial expertise in Malta can also be beneficial.

- IP Companies: For companies holding and exploiting intellectual property, substance might involve having personnel in Malta responsible for the development, enhancement, maintenance, protection, and exploitation (DEMPE) of that IP.

The key is always proportionality and genuine connection between the activity in Malta and the income attributed to the Maltese company.

Conclusion: Substance – The Non-Negotiable Element for Sustainable Tax Efficiency in Malta

In the contemporary global tax arena, demonstrating genuine economic substance is no longer a “nice-to-have” but an absolute necessity for any Maltese company seeking to robustly benefit from Malta’s attractive tax system and its network of double taxation treaties. The days of “letterbox” companies are over; tax authorities worldwide, including Malta’s, are focused on ensuring that profits are taxed where real value is created.

Building adequate substance in Malta involves a holistic approach, considering physical premises, qualified local personnel, genuine local decision-making by active directors, and incurring relevant operational expenditure. The level required will vary by business type and scale, but the underlying principle of genuine economic activity remains constant.

Proactive planning for substance should begin from the moment you consider Malta company formation. By working with experienced advisors like Contact Advisory Services Ltd., you can develop a strategy to establish and maintain a level of substance that not only meets regulatory expectations but also supports the long-term viability and integrity of your Maltese operations. This proactive approach is your best defence against challenges and ensures your Maltese structure remains effective and sustainable.

Are you planning to set up a company in Malta and need expert guidance on establishing appropriate economic substance?

Get in touch with Contact Advisory Services Ltd. today for a strategic consultation

Email: info@contact.com.mt