Extending Your Reach: A Complete Guide to Establishing a Branch Office in Malta

Malta’s strategic position in the EU, its business-friendly environment, and attractive operational advantages make it a prime target for international companies looking to expand their footprint. When considering how to establish a presence, many businesses automatically think of setting up a subsidiary – a new Maltese limited company. However, there’s another route, often perceived as simpler initially: establishing a Malta branch office.

But what exactly does setting up a branch entail? Is it truly simpler, or does it come with hidden complexities, particularly regarding liability and taxation? How does a foreign company, an “overseas company” in Maltese legal terms, actually register and operate a branch on the island?

This guide focuses solely on the Malta branch office structure. We’ll dissect the concept, walk through the specific registration requirements mandated by the Malta Business Registry (MBR), delve into the crucial tax implications, and weigh the pros and cons compared to forming a separate legal entity. If you’re exploring ways to directly extend your existing company’s operations into Malta without creating a distinct subsidiary, understanding the nuances of establishing a branch is essential.

Defining the Structure: What is a Malta Branch Office?

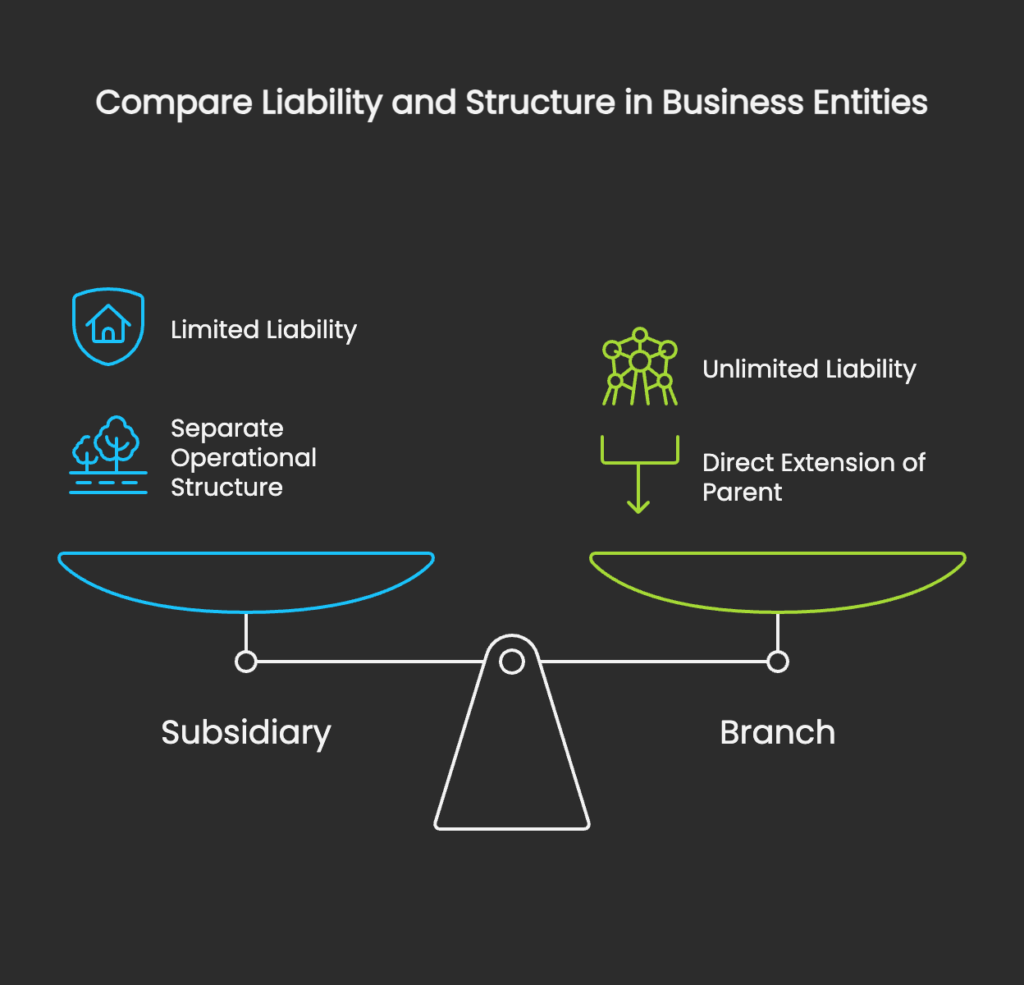

Crucially, a Malta branch office is not a separate legal entity. It is considered a direct extension of the foreign parent company (referred to as an “oversea company” under Maltese law). Think of it as the same company, simply operating from an additional location in Malta.

This fundamental characteristic has significant implications:

- Legal Personality: The branch does not have its own legal personality distinct from the parent company.

- Contracts & Assets: Contracts are entered into by the parent company (though potentially executed through the branch). Assets are owned by the parent company.

- Liability: This is the most critical point. Because the branch is not separate, the foreign parent company remains fully liable for all the debts and obligations incurred by its Malta branch office. There is no limited liability shield protecting the parent company’s assets from the branch’s activities.

Understanding this direct link and the associated unlimited liability for the parent company is paramount when considering the branch structure.

Why Consider a Branch Instead of a Subsidiary (Malta Ltd)?

While forming a Maltese subsidiary (typically a Private Limited Company or Ltd) is the most common route for Malta company formation due to liability protection, there are specific scenarios where establishing a branch might be considered:

- Market Testing: For companies wanting to test the Maltese or EU market before committing significant resources, a branch can offer a potentially quicker way to establish an initial operational presence.

- Simplified Initial Setup Perception: Some perceive the initial administrative steps for branch registration as slightly less complex than forming a new company with its own Memorandum & Articles, share capital structure, etc. (though ongoing compliance can differ).

- Direct Control & Branding: Operations are clearly under the direct control and branding of the parent company, which might be preferable for certain global brand consistency strategies.

- Specific Regulatory Requirements: In some regulated industries (e.g., certain financial services), operating as a branch of a well-established foreign entity might be a specific licensing requirement or offer certain advantages under passporting rules (though this is highly sector-specific).

- Utilising Parent Company Strength: Leveraging the parent company’s established financial standing and reputation directly, without needing to build credibility for a new entity.

However, these potential advantages must be weighed carefully against the significant drawback of unlimited parent company liability and potentially less favourable tax implications compared to a well-structured subsidiary.

Considering a subsidiary instead? Explore the benefits of forming a Malta Ltd: contact.com.mt/malta-company-formation/

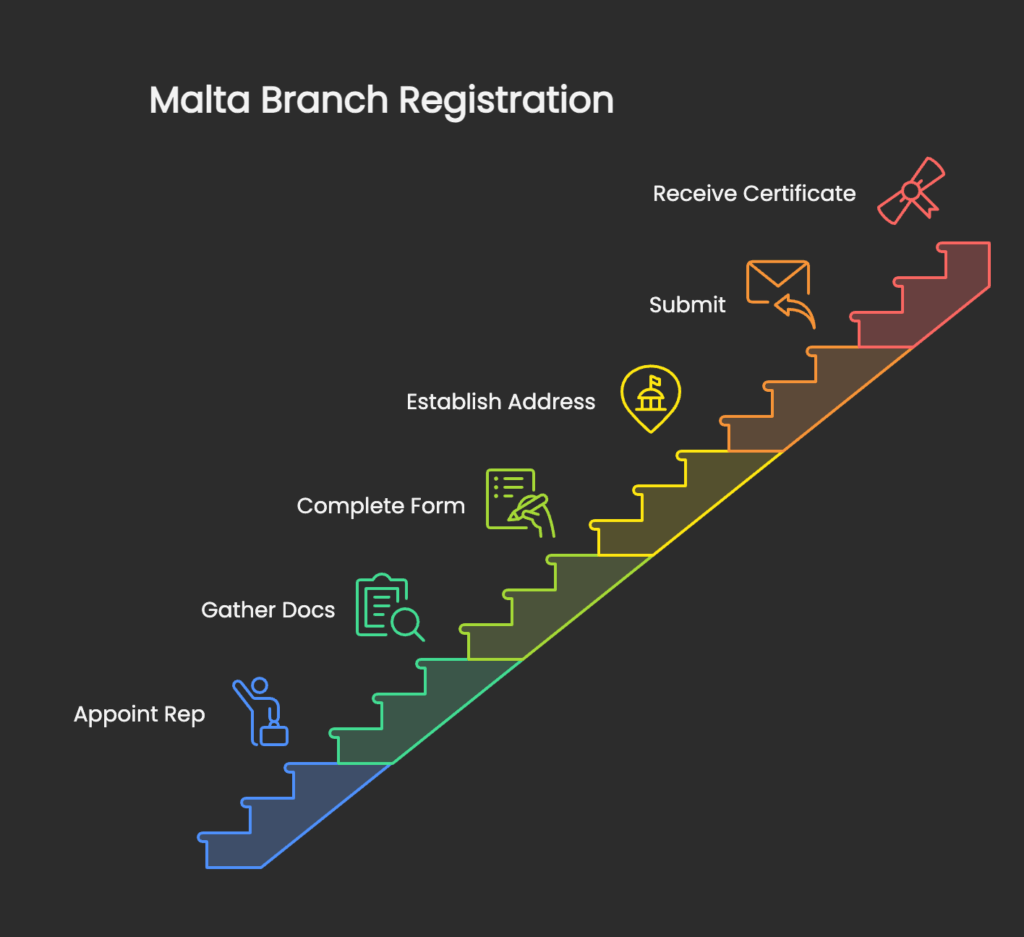

The Registration Process: Setting Up Your Malta Branch Office

Foreign companies intending to establish a branch office in Malta must register it as an “oversea company” with the Malta Business Registry (MBR) within one month of establishing the place of business in Malta. Failure to do so can result in penalties.

The process involves submitting specific documents relating to the parent company:

- Appoint a Local Representative: The oversea company must appoint at least one individual resident in Malta who is authorised to accept service of process and any notices required to be served on the company. This person acts as the official point of contact for Maltese authorities. This could be an employee resident in Malta or a representative provided by a corporate service provider like Contact Advisory Services Ltd.

- Gather Parent Company Documentation: You will need to provide certified copies of the parent company’s constitutional documents (e.g., Certificate of Incorporation, Memorandum & Articles of Association, Statute, or equivalent documents based on the parent’s country of origin).

- Certification: These copies must typically be certified as true copies by a notary public, a lawyer, or sometimes by the registrar of the parent company’s jurisdiction.

- Translation: If the original documents are not in English or Maltese, certified translations into English or Maltese are required.

- Obtain Parent Company Details: A list of the current directors and company secretary (or equivalent officers) of the parent company, containing their particulars (full name, address, nationality, ID/passport number), is needed.

- Complete MBR Forms: The MBR provides specific forms for the registration of an oversea company (Form BO1). This form requires details about the parent company, the Malta branch address, the appointed local representative, and the activities to be carried out in Malta.

- Establish a Registered Address in Malta: The branch must have a physical registered address in Malta where the local representative can be reached and official documents can be served. This cannot be a simple PO Box.

- Submission to MBR: The completed Form BO1, along with all certified (and translated, if necessary) supporting documents and the applicable registration fee, must be submitted to the MBR.

- Certificate of Registration: Once the MBR is satisfied with the documentation, it will register the oversea company and issue a Certificate of Registration confirming the branch’s establishment in Malta.

Malta Branch Registration: Key Requirements Checklist

To summarise, here are the essential requirements for registering a foreign company branch in Malta:

- Parent Company Existence: A legally constituted foreign company must exist.

- Establishment in Malta: Evidence of having established a place of business in Malta.

- Registration Timeframe: Register with the MBR within one month of establishment.

- Certified Parent Docs: Provide certified (and potentially translated) copies of the parent company’s constitutional documents.

- Parent Officer Details: List of current directors/secretary of the parent company.

- Malta Registered Address: A physical address in Malta for the branch.

- Local Representative: Appoint at least one Malta resident representative authorised to accept service.

- MBR Forms & Fees: Submit the correct MBR forms and pay the required registration fee.

Meeting these requirements diligently ensures a compliant oversea company registration in Malta.

Taxing Matters: Understanding Malta Branch Tax Implications

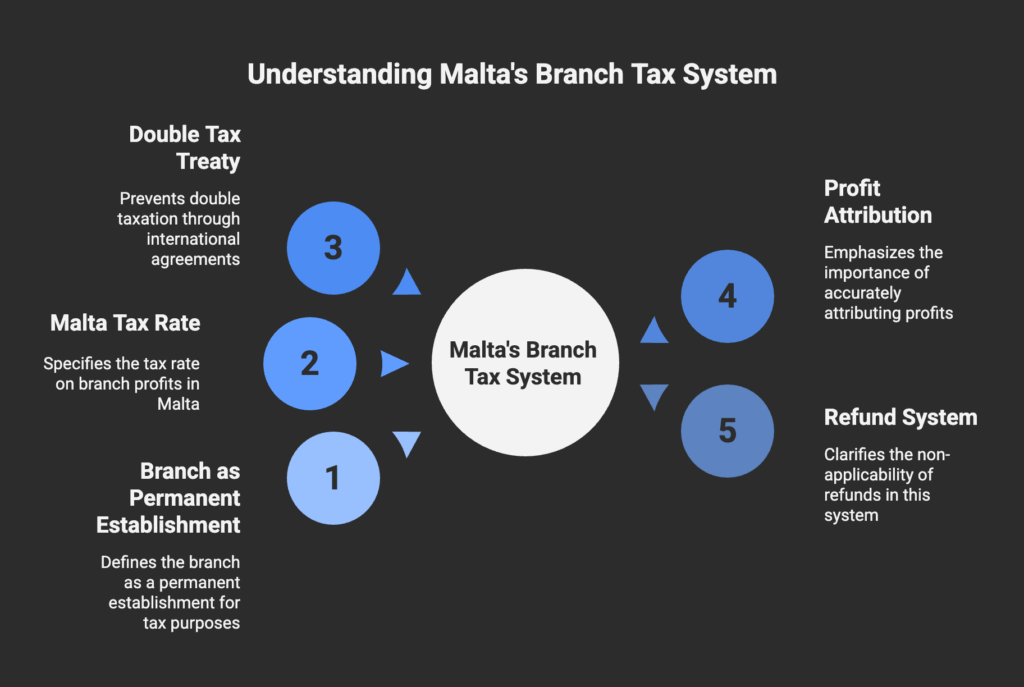

This is often the most complex area and requires careful consideration and professional advice. Here’s a breakdown of the key principles:

- Taxable Presence (Permanent Establishment): A Malta branch office typically constitutes a “permanent establishment” (PE) of the foreign parent company in Malta under most double taxation treaties (DTTs). This means the profits attributable to the branch’s activities in Malta are generally subject to Maltese corporate income tax.

- Malta Corporate Tax Rate: The standard corporate income tax rate in Malta is 35%. This rate applies to the taxable profits generated by the Malta branch.

- Profit Attribution: Determining the profits “attributable” to the branch can be complex. It’s generally based on the arm’s length principle – treating the branch as if it were a separate entity dealing independently with the parent company. This often involves transfer pricing considerations to allocate income and expenses appropriately between the head office and the branch. Proper accounting segregation is vital.

- Malta-Sourced Income Focus: Tax is generally levied on income arising in Malta or derived from activities carried out through the Maltese branch.

- Double Taxation Treaties (DTTs): Malta has an extensive network of DTTs. These treaties are crucial for branch operations. They:

- Define what constitutes a PE.

- Provide mechanisms to prevent double taxation of the branch profits (i.e., being taxed in both Malta and the parent company’s home country). This usually involves the home country granting a credit for Maltese taxes paid or exempting the branch profits from home country tax. The specific method depends on the treaty.

- Tax Refunds – A Key Distinction: Malta’s attractive tax refund system (whereby shareholders receiving dividends from a Maltese company can claim refunds on the tax paid by the company) generally does not apply directly to profits generated by a branch. Branches do not distribute dividends in the same way as companies; profits are simply repatriated to the head office. This lack of access to the shareholder refund system is a significant potential tax disadvantage compared to operating through a Maltese subsidiary (Ltd).

- VAT Registration: If the branch carries out activities subject to Value Added Tax (VAT) in Malta and exceeds the registration thresholds, it will need to register for VAT and comply with Maltese VAT rules.

Navigating Malta branch tax requires careful planning, robust accounting, and potentially expert advice to ensure compliance and mitigate double taxation effectively through applicable DTTs.

Staying Compliant: Ongoing Obligations for a Malta Branch

Registration isn’t a one-off event. A Malta branch office has ongoing compliance responsibilities:

- Filing Parent Company Accounts: The branch must annually deliver certified copies (and translations if needed) of the parent company’s global financial statements (balance sheet, profit and loss account) to the MBR. This means the parent’s worldwide financial information becomes publicly available in Malta.

- Branch Financial Statements (Potentially): While the primary requirement is filing parent accounts, specific accounting records relating to the branch’s Maltese operations must be kept to determine taxable profits. Depending on the nature and scale, separate branch accounts might be advisable or required for tax purposes.

- Tax Returns: The branch must file annual Maltese corporate income tax returns declaring the profits attributable to its Maltese operations and pay any tax due.

- VAT Returns (if applicable): Regular filing of VAT returns if registered.

- Notification of Changes: Any changes to the parent company’s details (name, registered office, directors, constitutional documents) or the Malta branch details (address, local representative) must be notified to the MBR within a specified timeframe.

Failure to meet these obligations can lead to penalties and legal issues for the parent company.

Weighing the Balance: Advantages of a Malta Branch Summarised

- Potentially Simpler Setup: Fewer steps involved compared to creating a new legal entity with its own M&A and share structure.

- Direct Control: Parent company retains full, direct operational control.

- Brand Unity: Operates directly under the established parent company name and brand.

- Easier Profit Repatriation (Potentially): Profits belong directly to the parent; no need for formal dividend distributions (though tax implications apply).

- Utilisation of Parent Losses (Limited Cases): In some specific circumstances and jurisdictions, losses incurred by the branch might be offset against profits of the parent company (highly dependent on home country tax law).

Weighing the Balance: Disadvantages and Key Considerations

- UNLIMITED PARENT LIABILITY: The most significant drawback. The parent company is fully exposed to all debts and liabilities of the Malta branch.

- Tax Inefficiencies: Lack of access to Malta’s shareholder tax refund system can result in a higher effective tax rate compared to a subsidiary structure. Profit attribution can be complex.

- Public Disclosure of Parent Accounts: The parent company’s global accounts must be filed publicly in Malta.

- Perception: Branches may sometimes be perceived as less permanent or committed than locally incorporated subsidiaries.

- Potential Banking Hurdles: Opening bank accounts for branches of foreign companies can sometimes face additional scrutiny compared to Maltese companies.

- Complexity in Closure: Dissolving a branch involves specific procedures to deregister the oversea company in Malta.

Expert Support for Your Malta Branch Establishment

Establishing and managing a Malta branch office involves navigating specific legal requirements for oversea companies, appointing local representation, understanding complex cross-border tax implications, and meeting ongoing compliance duties. Errors can expose the parent company to significant liability and financial penalties.

Contact Advisory Services Ltd. provides specialised support for foreign companies looking to establish a branch presence in Malta. As an MFSA Authorised Company Services Provider, we offer:

- Guidance on Structure: Helping you assess if a branch truly aligns with your goals versus forming a subsidiary.

- Registration Assistance: Managing the entire MBR registration process, including assistance with document certification and translation requirements.

- Local Representative Services: Acting as your required Malta-resident representative.

- Registered Office Address: Providing a compliant physical address in Malta.

- Liaison with Authorities: Communicating effectively with the MBR and tax authorities.

- Compliance Support: Assisting with annual filings of parent company accounts and advising on ongoing obligations.

- Coordination with Tax Advisors: Working alongside tax experts to address the specific Malta branch tax implications and DTT benefits.

We ensure your oversea company registration in Malta is handled professionally and efficiently, allowing you to focus on your core business activities.

Conclusion: Is a Malta Branch the Right Extension for Your Business?

Establishing a Malta branch office offers a direct way for a foreign company to extend its operations into the Maltese and EU markets without creating a new legal entity. Its perceived initial simplicity can be attractive for market testing or maintaining tight brand control.

However, this directness comes at the significant cost of unlimited parent company liability. Furthermore, the potential tax inefficiencies, particularly the general inapplicability of the shareholder tax refund system, and the requirement to publicly file the parent company’s global accounts, must be carefully weighed.

The Malta branch is a viable structure in specific circumstances, but it’s crucial to understand its inherent link to the parent company and the resulting implications. For many businesses seeking long-term presence, liability protection, and potentially greater tax optimisation, forming a Maltese subsidiary (Ltd) often proves to be the more strategically sound approach.

Unsure whether a branch or a subsidiary best suits your expansion plans in Malta? Let Contact Advisory Services Ltd. provide clarity and expert guidance.

Contact us today for a detailed discussion:

Email: info@contact.com.mt