Demystifying Share Capital in Malta: What You Really Need to Pay Upfront. Minimums Paid-up Rules for Ltd & PLC

When embarking on the journey of Malta company formation, numerous legal and financial terms come to the fore. Among these, “share capital” is fundamental, yet often a source of confusion for aspiring entrepreneurs and businesses. Questions abound: What is the absolute minimum required? What does “authorized” versus “issued” versus “paid-up” capital actually mean in practice? And critically, how much cash do you really need to have available upfront before your Maltese company can be registered?

Misunderstanding these requirements can lead to delays in incorporation, incorrect financial planning, or even non-compliance. This is especially true when considering the two primary limited liability structures: the widely used Private Limited Company (Ltd) and the more demanding Public Limited Company (PLC). Their share capital requirements differ significantly, reflecting their distinct purposes and scales.

As seasoned corporate services consultants at Contact Advisory Services Ltd., we regularly clarify these concepts for our clients. This article aims to provide a clear, practical explanation of minimum share capital in Malta, specifically addressing the requirements for Ltds and PLCs. We’ll break down the jargon and pinpoint exactly what portion of that capital needs to be paid into the company before the Malta Business Registry (MBR) will issue your Certificate of Registration.

Understanding the Basics: What is Share Capital?

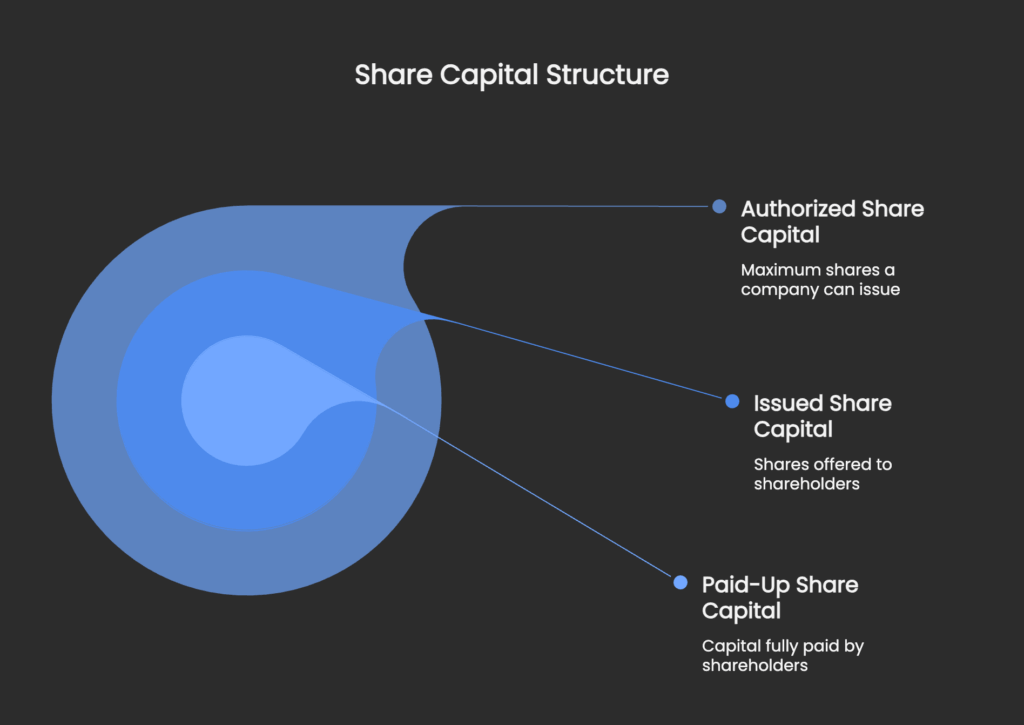

Share capital represents the funds raised by a company through the issuance of shares to its shareholders. It’s a measure of the owners’ equity stake in the company and traditionally served as a (sometimes nominal) cushion for creditors. Key terms to understand are:

- Authorized Share Capital: This is the maximum amount of share capital that a company is permitted to issue, as stated in its Memorandum of Association. Think of it as the company’s potential cap for raising equity through shares without needing to amend its constitutional documents.

- Issued Share Capital: This is the portion of the authorized share capital that has actually been issued to shareholders. It cannot exceed the authorized share capital. For new companies in Malta, the minimum authorized share capital is typically also the initial issued share capital.

- Paid-Up Share Capital: This is the crucial part. It’s the amount of the issued share capital for which the company has actually received payment from the shareholders. It’s the cash (or other assets, in some cases) that has physically been contributed to the company in exchange for shares.

The Malta Business Registry (MBR) is primarily concerned with ensuring that the minimum issued share capital and, critically, the minimum paid-up portion of that capital meet the requirements of the Companies Act before registration.

Malta Private Limited Company (Ltd): Accessible Capital Requirements

The Private Limited Company (Ltd) is the most popular structure for business registration in Malta, favoured by startups, SMEs, family businesses, and international subsidiaries due to its flexibility and relatively low setup thresholds. This accessibility extends to its share capital requirements.

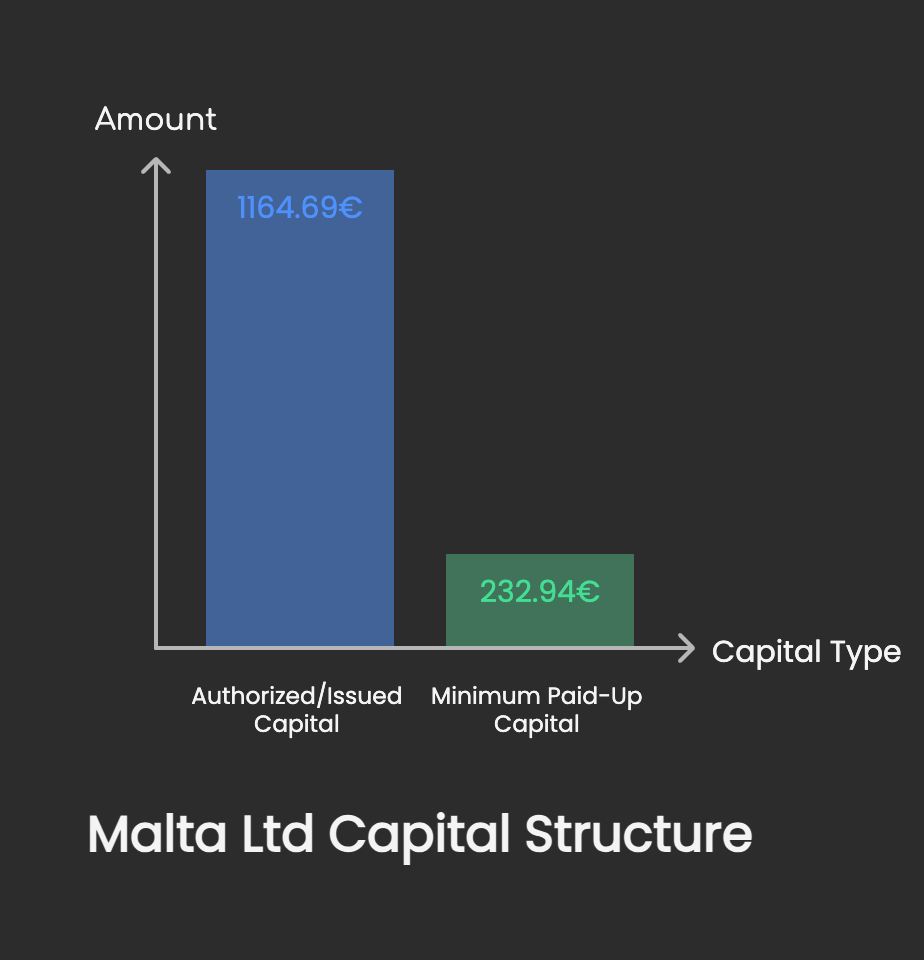

Minimum Authorized (and Issued) Share Capital for a Malta Ltd:

- The minimum authorized share capital required for a Malta Private Limited Company is €1,164.69.

- Upon incorporation, at least this minimum amount must be subscribed to by the shareholders (i.e., it becomes the initial issued share capital).

Minimum Paid-Up Share Capital for a Malta Ltd:

- This is the key figure for upfront cash requirements. For a Malta Ltd, at least 20% of the nominal value of each issued share must be paid up before the company can be registered.

- Therefore, for a company with the minimum issued share capital of €1,164.69, the minimum amount that must be paid up upfront is:

€1,164.69 x 20% = €232.94 (approximately)

What This Means in Practice:

Before the MBR will register your Malta Ltd, you (or the subscribers/shareholders) must demonstrate that at least €232.94 has been deposited into a bank account opened in the name of the company “in formation” (or provide other acceptable proof of payment for shares). This is the “real” upfront cash you need specifically for the share capital requirement of a minimum-level Ltd.

- Currency: While the minimum is stated in Euros, the share capital can be denominated in any major currency, provided the equivalent value meets the Euro minimum at the time of incorporation.

- Beyond the Minimum: Companies can, of course, opt for a higher authorized and issued share capital if desired, and consequently, the 20% paid-up portion would be higher. This might be done to reflect a more significant initial investment or to project a stronger financial base.

Understanding this relatively low paid-up threshold makes the Malta Ltd a very attainable structure for many new businesses seeking the benefits of incorporating in Malta.

Malta Public Limited Company (PLC): A Higher Capital Threshold for Public Ambitions

The Public Limited Company (PLC) is designed for larger enterprises, particularly those intending to raise capital from the public by offering shares (e.g., via a stock exchange listing). Reflecting this public nature and greater scale, the share capital requirements are substantially higher.

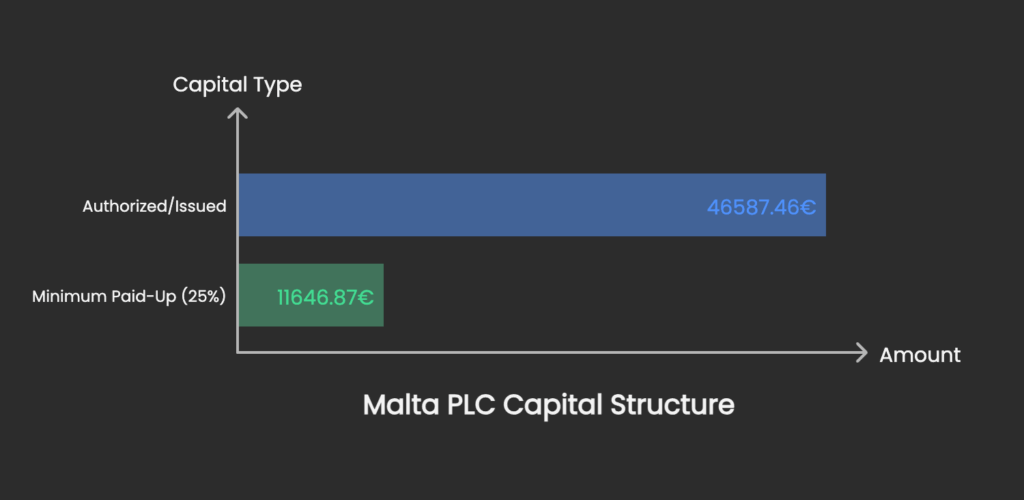

Minimum Authorized (and Issued) Share Capital for a Malta PLC:

- The minimum authorized share capital required for a Malta Public Limited Company is €46,587.46.

- As with the Ltd, at least this amount must be subscribed upon incorporation.

Minimum Paid-Up Share Capital for a Malta PLC:

- For a Malta PLC, at least 25% of the nominal value of each issued share must be paid up before the company can be registered.

- Therefore, for a company with the minimum issued share capital of €46,587.46, the minimum amount that must be paid up upfront is:

€46,587.46 x 25% = €11,646.87 (approximately)

What This Means in Practice:

The upfront cash requirement for the paid-up share capital of a PLC is significantly more substantial, reflecting the expectation that PLCs are more substantial entities. Proof of this €11,646.87 (or more, if a higher capital is chosen) being paid into the company’s account is a prerequisite for MBR registration.

This higher threshold is one of the key differentiators when businesses are deciding between a Malta PLC vs. Ltd structure. If public fundraising isn’t an immediate goal, the capital demands of a PLC can be prohibitive for many.

The “Payment” for Shares: Cash and Non-Cash Considerations

While the most common way to pay for shares is in cash (deposited into the company bank account), Maltese law also allows for shares to be paid up, wholly or in part, by a consideration other than cash (e.g., assets, services rendered), subject to specific conditions:

- Valuation: For non-cash considerations, a detailed report prepared by an independent expert (typically an auditor) confirming the value of the non-cash consideration is generally required by the MBR. The expert must opine that the value of the consideration is at least equal to the nominal value of the shares being issued for it.

- Complexity: Opting for non-cash consideration for the initial paid-up capital adds complexity and cost (due to the expert valuation report) to the incorporation process. It’s more common in specific scenarios like group restructurings or mergers rather than typical startup formations.

- PLCs and Non-Cash: For PLCs, the rules around non-cash consideration for initial share capital can be even more stringent, reflecting the need for greater transparency and protection of public investors.

For most new Malta Ltds, satisfying the minimum paid-up requirement via a simple cash deposit is the most straightforward and cost-effective approach during the initial company registration in Malta.

Proof of Payment: Satisfying the Malta Business Registry

The MBR needs evidence that the minimum paid-up share capital has indeed been contributed to the company before it will issue the Certificate of Registration. The most common form of proof is:

- Bank Deposit Slip / Bank Confirmation: A copy of the deposit slip or a letter from the bank confirming that the requisite funds have been deposited into an account opened in the name of the company “in formation.” This is why initiating the bank account opening process (even if it’s an interim “account in formation”) often runs concurrently with preparing incorporation documents.

If you’re working with a corporate service provider like Contact Advisory Services Ltd., we guide you on obtaining the correct proof and ensure it’s included with your MBR submission. This meticulous attention to detail is part of ensuring a smooth Malta business setup.

What Happens if Share Capital is Not Fully Paid Up Initially?

It’s important to remember that the requirement is for a minimum percentage (20% for Ltd, 25% for PLC) of the issued share capital to be paid up before registration. The remaining portion of the issued share capital (the “uncalled capital” or “unpaid capital”) represents a debt owed by the shareholders to the company.

- Calling Up Unpaid Capital: The company, through its directors, can “call” upon the shareholders to pay the outstanding amounts on their shares at a later date, as and when the company requires those funds.

- Liability of Shareholders: Shareholders remain liable to the company for the unpaid portion of their shares.

For initial incorporation, however, the focus is squarely on meeting that upfront minimum paid-up percentage.

Share Capital: Beyond the Legal Minimum

While this article focuses on the minimum legal requirements, it’s worth noting:

- Operational Needs: The minimum paid-up capital (€232.94 for an Ltd) is often insufficient to cover initial operating expenses. Businesses need to plan for actual startup costs beyond just meeting this legal share capital floor.

- Credibility: A company with a higher issued and paid-up share capital might be perceived as more financially stable or credible by banks, suppliers, or potential clients, especially in certain industries.

- Future Funding: While initial capital is low, if you anticipate needing significant funding quickly, planning your authorized share capital from the outset can provide flexibility for future share issues without needing immediate M&A amendments.

Deciding on the appropriate level of share capital for your new Maltese company involves balancing the legal minimums with your business’s practical financial needs and strategic goals. We often discuss these broader considerations with clients during the Malta company formation process.

How Contact Advisory Services Ltd. Guides You on Share Capital

Navigating share capital requirements is a fundamental part of our service at Contact Advisory Services Ltd. We ensure clarity and compliance by:

- Explaining Requirements: Clearly outlining the minimum authorized and paid-up capital for your chosen structure (Ltd or PLC).

- Advising on Currency: Discussing denomination options if not Euros.

- Facilitating Proof of Payment: Guiding you on how to evidence the paid-up capital to the MBR, often coordinating with banking introductions.

- Drafting M&A Clauses: Ensuring the Memorandum of Association accurately reflects the agreed share capital structure.

- Handling MBR Submissions: Including all necessary share capital information and proof in the incorporation application.

Our aim is to demystify these financial prerequisites, making this aspect of your Malta company registration straightforward and compliant.

Conclusion: Meeting the Capital Threshold for Your Maltese Venture

Understanding Malta’s minimum share capital requirements is essential for any entrepreneur or business looking to establish a presence on the island. For a Private Limited Company (Ltd), the path is highly accessible, with a minimum authorized and issued share capital of €1,164.69, and crucially, only 20% of this (€232.94) needing to be paid up upfront before registration. This low entry point makes the Malta Ltd an attractive proposition.

For Public Limited Companies (PLCs), designed for larger-scale operations and public investment, the requirements are understandably more substantial: a minimum authorized and issued share capital of €46,587.46, with at least 25% (€11,646.87) paid up upfront.

Meeting these paid-up capital requirements, typically through a cash deposit into the company’s bank account in formation, is a non-negotiable step for MBR approval. While the legal minimums are clear, businesses should also consider their broader operational funding needs.

By clarifying these authorized, issued, and particularly the paid-up capital rules, we hope to remove any ambiguity, allowing you to plan your Malta company setup with financial confidence.

Have more questions about share capital or ready to start the Malta company formation process? The experienced team at Contact Advisory Services Ltd. is here to help. Get in touch for expert, personalized guidance:

Email:info@contact.com.mt