Malta Company Formation: The Definitive 2025 Guide

Table of Contents

Introduction

Are you an entrepreneur or an established business seeking a strategic European base with unparalleled financial advantages? The global commercial landscape is more competitive than ever, demanding not just innovation and efficiency, but a strategic corporate structure that can maximize growth and minimize fiscal drag. In this complex environment, the process of Malta company formation emerges as a compelling and sophisticated solution, providing full access to the vast EU single market combined with a highly efficient and fully compliant tax system. This definitive guide will walk you through every critical step of this journey. We will delve deep into the core benefits, explore the nuances of choosing the right legal structure, navigate the specific costs and fees, and demystify the post-registration compliance landscape. Our goal is to ensure your Malta company setup is not just a procedural step, but a strategic cornerstone for your international success.

Why Should You Choose Malta for Your Company Formation?

You should choose Malta for your company formation primarily for its strategic access to the European Union’s single market, its highly advantageous and EU-compliant corporate tax system which can result in an effective rate of 5%, and its stable, pro-business economic environment. The island nation offers a streamlined registration process, a highly skilled and English-speaking workforce, and a robust regulatory framework, making it an ideal and reputable gateway for international business operations.

Malta has carefully crafted its reputation as a premier jurisdiction for international business, offering a unique and powerful blend of benefits that are difficult to replicate elsewhere. As a full EU member state since 2004, and part of the Eurozone since 2008, Malta provides businesses with a reliable, credible, and prestigious European base. This membership is far more than a geographical or political designation; it is a golden ticket to a frictionless commercial environment encompassing a market of over 450 million consumers. It allows for the free movement of goods, services, capital, and people across 27 member states, a fundamental and non-negotiable advantage for any business with ambitions of scaling within Europe.

However, what truly distinguishes the Malta company setup from other EU jurisdictions is its innovative, intelligent, and attractive tax regime. While the headline corporate tax rate is 35%, this figure, when viewed in isolation, is deeply misleading. Malta operates a full imputation system of taxation, a sophisticated mechanism designed to completely eliminate the economic double taxation of company profits. More importantly for international shareholders, it offers a generous and straightforward tax refund system upon the distribution of dividends. For profits generated from active trading activities, this can result in a 6/7ths refund of the tax paid by the company, which effectively reduces the ultimate tax burden to a mere 5%. This profound fiscal efficiency is a powerful magnet for businesses globally, freeing up significant capital for reinvestment, innovation, and accelerated growth.

Beyond the compelling numbers, Malta offers a robust, stable, and welcoming ecosystem for businesses to thrive. Its political and economic environment is characterized by a remarkable consistency and a forward-thinking, pro-business government that actively seeks to attract and retain foreign investment. The country’s legal framework, which is a unique hybrid of the civil law and common law traditions, is transparent, reliable, and fully harmonized with EU directives, providing a bedrock of legal certainty for investors.

The human capital available in Malta is another significant asset. The workforce is highly educated, exceptionally skilled in key growth sectors like finance, iGaming, blockchain, and technology, and is fully bilingual, with English being an official language of business and law. This is complemented by a first-rate infrastructure, including cutting-edge telecommunications, world-class financial services, and excellent air and sea links that position Malta as a logistical hub connecting Europe, North Africa, and the Middle East.

What Are the Key Strategic Advantages of a Maltese Company?

The key strategic advantages of a Maltese company include unrestricted and frictionless access to the EU single market, an effective corporate tax rate that can be reduced to as low as 5% (or 0% for holding companies), a vast network of over 70 double tax treaties to prevent international double taxation, and a remarkably streamlined and efficient company registration process. Furthermore, Malta offers a consistently stable political and economic climate, a highly skilled English-speaking workforce, and a complete absence of exchange control restrictions, ensuring total financial freedom.

When you register company in Malta, you are not just creating a legal entity; you are unlocking a suite of integrated strategic benefits that collectively create a powerful and resilient platform for international growth.

- Unrestricted EU Market Access: As a full EU member, a Maltese company is, by definition, an EU company. This provides immediate and seamless access to the European single market. This means your business can trade goods, provide services, and move capital across all 27 member states without being hindered by internal borders, customs duties, or restrictive tariffs. For financial services, this translates into valuable “passporting” rights, allowing a licensed entity to operate across the EU from its Maltese base.

- Highly Efficient Corporate Tax System: This is the cornerstone of Malta’s appeal. The tax refund system is the key mechanism. It allows shareholders of trading companies to effectively reduce their tax rate from 35% to a final rate of approximately 5%. For income derived from qualifying patents and copyrights, the effective rate can be even lower. For holding companies, the combination of a full tax refund and the participation exemption on dividends and capital gains can reduce the effective tax rate to an incredible 0%.

- Extensive Double Tax Treaty Network: Malta has proactively negotiated an extensive network of over 70 double tax treaties with major economies worldwide, including the US, China, and most of Europe. These bilateral agreements are crucial for international businesses as they provide a clear framework to prevent the same income from being taxed in two different countries, thereby eliminating double taxation and providing certainty and significant tax savings.

- Fast and Efficient Incorporation: The Malta Business Registry (MBR) is renowned for its modern, digital-first approach and efficiency. With a complete and correct set of documentation submitted by an authorized provider, a new company can typically be incorporated within 2-5 working days. This speed to market allows businesses to become operational and start generating revenue remarkably quickly.

- Stable Political and Economic Environment: Malta enjoys a long and proven history of political stability, with a multi-party democratic system. Its economy has consistently demonstrated resilience and strong growth, earning favorable ratings from major international credit agencies. This provides a secure, predictable, and reliable environment for long-term investment and strategic business planning.

- English-Speaking, Skilled Workforce: English is an official language in Malta, enshrined in law and used universally in business, education, and daily life. This completely eliminates communication barriers for international businesses. Furthermore, the workforce is well-educated and highly skilled, with the University of Malta and other tertiary institutions producing a steady pipeline of talent in finance, law, accounting, IT, and other professional disciplines.

- No Exchange Control Restrictions: Malta operates a completely free-market economy with no exchange control restrictions whatsoever. This allows for the free and unrestricted movement of capital and profits in and out of the country without bureaucratic hurdles or government levies, providing businesses with total financial flexibility.

- Reputable Financial Jurisdiction: Malta is a well-regulated and respected onshore financial center. It is not a “tax haven” but a fully compliant jurisdiction that adheres to all EU and OECD standards. Operating from Malta lends credibility and prestige to your business, ensuring it is viewed as a serious and legitimate enterprise on the global stage.

What Types of Company Structures Are Available in Malta?

The most common and versatile company structure available in Malta is the Private Limited Liability Company (Ltd), which is ideal for the vast majority of businesses due to its exceptional flexibility and robust limited liability protection. Other available structures are more specialized and include the Public Limited Company (plc) for businesses intending to raise capital from the public, Partnerships (both general and limited) for smaller or professional collaborations, and Branch Offices for foreign companies wishing to establish a direct presence.

Choosing the right legal entity is a foundational and strategic step in your Malta company formation journey. The structure you select will have a profound and lasting impact on critical aspects of your business, including personal liability, capital requirements, governance protocols, tax treatment, and administrative burden. Malta’s Companies Act provides a versatile range of options, each tailored to suit diverse business needs, from solo entrepreneurs to large multinational corporations.

What Is a Private Limited Liability Company (Ltd)?

A Private Limited Liability Company (Ltd) in Malta is a distinct legal entity where the liability of its shareholders is strictly limited to the amount of capital they have invested in the company. It is by far the most popular and widely used corporate vehicle for startups, Small and Medium-sized Enterprises (SMEs), and international businesses due to its low setup requirements, operational flexibility, and the strong legal protection it affords its owners.

The Private Limited Company is the undisputed workhorse of the Maltese business landscape. Its immense popularity stems from a perfectly engineered balance of robust legal protection, operational simplicity, and unmatched flexibility.

Key Features of a Maltese Ltd:

- Limited Liability: This is the cornerstone feature and primary benefit. The principle of limited liability creates a strong legal “veil” between the company and its owners (the shareholders). This means that the personal assets of the shareholders—such as their homes, savings, and other investments—are completely protected from business debts, lawsuits, and other liabilities. Their financial risk is legally capped at the value of the shares they hold.

- Separate Legal Personality: From the moment of incorporation, the company becomes a legal entity in its own right, entirely separate and distinct from its shareholders and directors. It can own property, enter into contracts, borrow money, sue, and be sued, all in its own name. This separation is crucial for business continuity and professional credibility.

- Low Share Capital Requirement: The minimum authorized share capital for a private company is set at a highly accessible €1,164.69. More importantly, only 20% of this amount, a mere €232.94, needs to be paid up in cash at the time of incorporation. This extremely low barrier to entry makes the Malta company setup a financially viable option for entrepreneurs and businesses of all sizes.

- Flexible Shareholder & Director Structure: A Maltese private company offers incredible structural flexibility. It can be established with just one shareholder and one director. The shareholder and the director can be the same person, providing a simple structure for solo entrepreneurs. Furthermore, there are absolutely no residency or nationality requirements for either position; shareholders and directors can be from anywhere in the world.

- Privacy and Control: Unlike a public company, the shares of a private company cannot be offered to the general public. This ensures that ownership remains within a controlled group, providing a greater degree of privacy and allowing the original founders or owners to maintain tight control over the company’s direction and strategy.

This structure is exceptionally versatile and ideal for virtually any type of trading or holding activity imaginable, from e-commerce platforms and digital marketing agencies to international trade consultancies and intellectual property holding companies. Its straightforward nature and robust legal protections make it the default and highly recommended choice for the vast majority of clients we assist.

What Is a Public Limited Liability Company (plc)?

A Public Limited Liability Company (plc) in Malta is a more complex corporate structure specifically designed for larger, well-established enterprises that intend to raise significant amounts of capital by offering their shares to the public. Consequently, it is subject to a stricter regulatory regime and higher capital requirements to ensure transparency, accountability, and the protection of public investors.

For businesses with ambitious growth plans that require substantial capital infusion beyond what private investors can offer, the plc structure is the appropriate and necessary vehicle. It provides the legal framework that allows a company to tap into public capital markets, most notably by listing its shares for trading on a recognized stock exchange, such as the Malta Stock Exchange.

Key Features of a Maltese plc:

- Access to Public Capital: The primary and defining advantage of a plc is its legal capacity to issue shares and other securities (like debentures and bonds) to the general public. This provides access to a much wider and deeper pool of investment capital than is available to a private company.

- Higher Minimum Share Capital: Reflecting its larger scale and public nature, a plc requires a significantly higher minimum authorized share capital of €46,587.46. To ensure the company is adequately capitalized from the outset, at least 25% of this amount (€11,646.86) must be paid up in cash before the company can be registered.

- Stricter Governance and Reporting: A plc must have a minimum of two directors to ensure a degree of separation of powers and oversight. It is also subject to far more stringent reporting, financial disclosure, and compliance requirements under the Companies Act and, if listed, the detailed rules of the stock exchange. This includes more comprehensive annual reports and adherence to corporate governance codes.

- Enhanced Credibility and Profile: Being a plc, and especially a publicly listed one, often enhances a company’s public profile, market visibility, and corporate credibility. This can be highly beneficial in attracting major business partners, securing large contracts, and building trust with customers and suppliers.

The path to establishing a plc is more intricate and costly, and it is typically pursued by mature, well-established businesses looking to fund major expansion projects, large-scale acquisitions, or significant research and development initiatives.

What Is a Societas Europaea (SE)?

A Societas Europaea (SE) in Malta is a prestigious pan-European public limited company, governed by an EU-level legal framework that allows it to operate across the entire European Union under a single brand and corporate structure. It is specifically designed for large, cross-border businesses seeking to simplify their European operations, reduce administrative complexity, and present a truly unified European identity.

The SE is the pinnacle of European corporate structures, representing a company’s deep integration and commitment to the EU single market. Its creation is intended to overcome the legal and practical obstacles arising from 27 different national legal systems, making it the ideal vehicle for major multinational corporations, significant cross-border mergers, and businesses with operations spanning multiple EU jurisdictions.

Key Features of a Maltese SE:

- Pan-European Legal Status: The defining feature of the SE is its unique European legal personality. An SE registered in Malta is recognized as the same legal entity in every EU member state. This allows it to transfer its registered office from one member state to another with minimal administrative burden, a process that is exceptionally complex and costly for national companies.

- High Minimum Share Capital: Reflecting its intended use by large-scale enterprises, an SE must have a minimum subscribed share capital of at least €120,000. This substantial capital requirement ensures the entity is well-funded and credible from its inception, underpinning its significant cross-border activities.

- Flexible Formation Methods: An SE cannot be formed from scratch. It must be created from existing national companies through specific, regulated methods, such as the merger of two or more public limited companies from different EU member states, or the conversion of an existing national plc into an SE, provided it has a subsidiary in another member state.

- Mandatory Employee Involvement: A unique and critical aspect of the SE is the mandatory requirement to negotiate with employee representatives on their future involvement in the company. These rules cover information, consultation, and potential board-level participation, ensuring that employees’ rights are protected in the newly formed European-scale business. Registration of the SE is conditional upon the successful conclusion of these negotiations.

- Corporate Governance Flexibility: The SE framework acknowledges the diverse corporate traditions across Europe. It allows a company to choose between a one-tier governance system (with a single administrative board) or a two-tier system (with a separate management board and a supervisory board), providing structural flexibility not always available under national law.

This structure is therefore not suited for startups or SMEs but is a powerful and sophisticated strategic tool for established multinational businesses aiming to streamline their European group structure, facilitate cross-border mergers and acquisitions, and operate seamlessly throughout the EU single market.

What Are Partnerships in Malta?

Partnerships in Malta are business structures formed by an agreement between two or more partners and come in two principal forms: the General Partnership (known as en nom collectif), where all partners have unlimited personal liability for the partnership’s debts, and the Limited Partnership (known as en commandite), which includes both general partners with unlimited liability and limited partners whose liability is capped at their investment amount.

Partnerships offer a simpler and often less administratively burdensome alternative to incorporated companies, making them particularly suitable for certain types of professional practices (like law or accounting firms) or specific joint ventures. They are governed by a legally binding partnership deed, which is a critical document outlining the rights, responsibilities, and profit-sharing arrangements of the partners.

- General Partnership (En Nom Collectif): In this traditional partnership structure, all partners are jointly and severally liable for all of the partnership’s debts and legal obligations, without any limit. This means that if the partnership cannot pay its debts, creditors can pursue the personal assets of any of the partners. This structure is therefore based on a very high degree of mutual trust and is best suited for small, closely-knit professional teams.

- Limited Partnership (En Commandite): This is a more sophisticated and flexible structure that offers a hybrid liability model, combining elements of both a partnership and a limited company. It must have at least one “general partner” who has unlimited liability and is responsible for the day-to-day management of the business. It also has one or more “limited partners” whose liability is strictly restricted to the amount of capital they have contributed. These limited partners are typically passive investors and are legally prohibited from participating in the management of the partnership.

What Is a Branch Office?

A branch office in Malta is not a separate legal entity in itself but is legally considered an extension of a foreign parent company. It provides a straightforward mechanism for an overseas company to establish a physical presence, conduct business, and generate revenue in Malta, with the parent company remaining fully and directly liable for all of its operations, contracts, and debts.

For foreign companies wishing to establish a direct presence in Malta without the time and expense of creating a new subsidiary, setting up a branch office is a strategically sound option. This route is often preferred for “testing the waters” in the Maltese and wider EU market, for executing specific projects with a defined timeframe, or for situations where a separate legal entity is not required for operational or tax reasons.

Key Features of a Branch Office:

- Extension of Parent Company: The branch operates under the same name and generally conducts the same business activities as its foreign parent company. It does not have its own separate legal personality, board of directors, or share capital.

- No Minimum Share Capital: As it is not a separate company, there are no share capital requirements for establishing a branch, which can make it a more cost-effective entry strategy.

- Parent Company Liability: This is a critical legal point to understand. The foreign parent company is fully and directly liable for all the debts, legal actions, and contractual obligations of its Maltese branch. There is no limited liability protection.

- Registration Requirement: A branch is not incorporated, but it must be registered with the Malta Business Registry within one month of establishing a place of business in Malta. It must also appoint a local representative who is responsible for liaising with the authorities and ensuring compliance.

How Do You Register a Company in Malta?

To register a company in Malta, you must first choose a unique and compliant company name and decide on the most appropriate legal structure, then accurately draft the company’s constitutional documents, the Memorandum and Articles of Association (M&A). Next, you must deposit the required minimum share capital into a Maltese bank account and then submit the complete application package, including the M&A and comprehensive due diligence documents for all involved individuals, to the Malta Business Registry for its review, approval, and the final issuance of the Certificate of Registration.

The process to register company in Malta is globally recognized for its remarkable efficiency, transparency, and clarity. At Contact Advisory Services Ltd., we have systematically refined this process into a seamless, predictable, and stress-free experience for our clients. We act as your licensed and authorized agent, liaising directly and efficiently with the Malta Business Registry (MBR) on your behalf, ensuring that every legal and administrative step is handled with the utmost precision, professionalism, and speed.

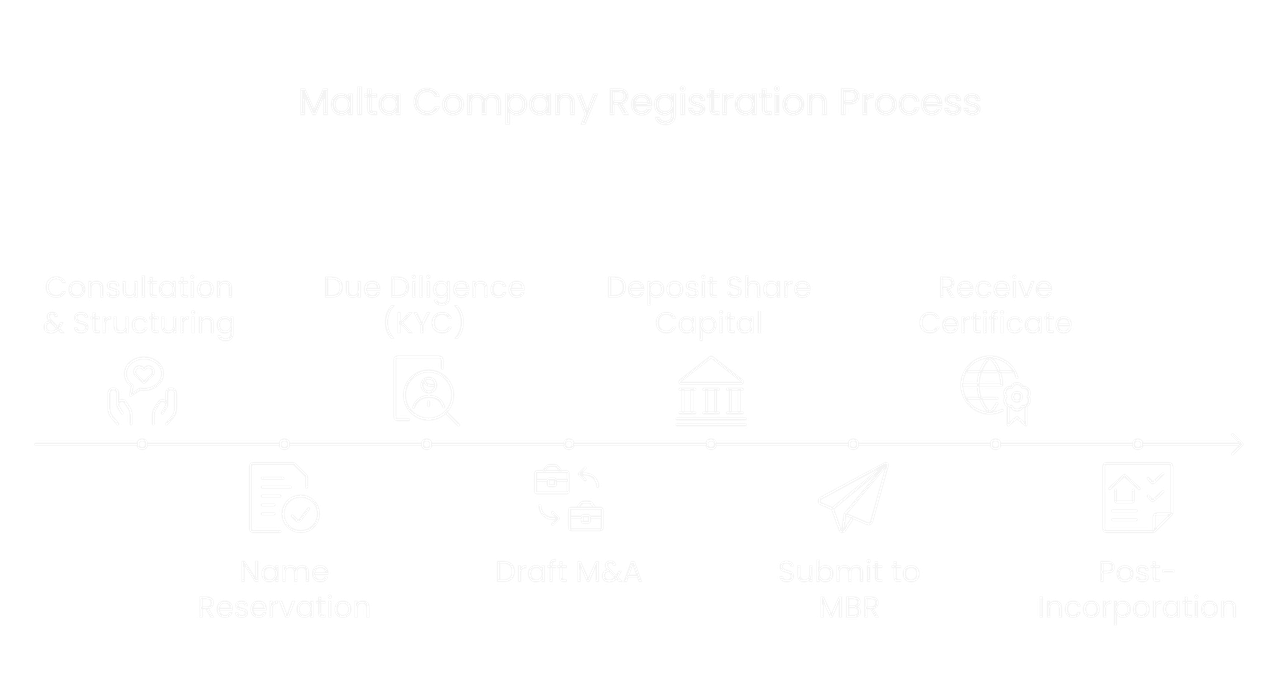

What Is the Step-by-Step Company Registration Process?

The step-by-step company registration process in Malta involves eight key stages, beginning with a strategic consultation and structuring phase. This is followed by the reservation of the company name, the thorough collection of due diligence (KYC) documents, the expert drafting of the statutory documents (M&A), the depositing of the initial share capital, the formal submission of the complete application to the MBR, receiving the official Certificate of Registration, and finally, completing all necessary post-incorporation registrations for tax and employment purposes.

Here is a detailed, granular breakdown of the journey from an initial business concept to a fully formed and operational Maltese company:

Step 1: Initial Consultation & Strategic Structuring

The entire process begins with a deep-dive consultation to fully understand your business model, operational needs, and long-term commercial objectives. Based on this, we provide strategic advice on the most suitable company structure (which is typically a Private Ltd Co.), the optimal shareholding and directorship configuration to meet both your control requirements and international substance standards, and a clear overview of the tax implications and opportunities. This foundational step is critical to ensure that the entire Malta company setup is perfectly aligned with your strategic goals from day one.

Step 2: Due Diligence & KYC Compliance

As a licensed and regulated entity, we are legally mandated to conduct thorough Know Your Customer (KYC) and due diligence checks on all individuals who will be involved in the company as directors, shareholders, or ultimate beneficial owners. This is a mandatory and non-negotiable step to comply with stringent national and EU anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. This rigorous process is also what upholds Malta’s reputation as a clean and compliant jurisdiction.

Step 3: Company Name Reservation and Approval

You will provide us with several proposed names for your new company, listed in order of preference. We will then conduct an immediate check with the Malta Business Registry’s online portal to ensure the proposed name is unique and not confusingly similar to any existing company name. We also ensure it complies with all naming regulations (e.g., it must end with “Limited” or “Ltd.” and must not contain any restricted or sensitive words like ‘Bank’ or ‘Trust’ without a special license). Once a name is approved, we can officially reserve it for you, securing it for a period of three months.

Step 4: Drafting the Memorandum & Articles of Association (M&A)

The M&A is the legal constitution of your company; it is the single most important document in its creation. We will expertly draft this bespoke legal document for you. It will be tailored to your specific needs but will legally be required to include:

- The full company name and the registered office address in Malta.

- The “objects” of the company, detailing the principal business activities it will undertake.

- Full details of the authorized and issued share capital, including the number of shares and their value.

- The full names, addresses, and identification details of the initial shareholders, directors, and the company secretary.

- The internal regulations governing the operation of the company, such as the rules for board meetings, shareholder voting, and the transfer of shares.

Step 5: Depositing the Initial Share Capital

The minimum paid-up share capital (€232.94 for a standard private company) must be deposited into a dedicated company bank account that is in the process of being opened. We will then obtain an official bank deposit slip or confirmation letter from the bank, which serves as irrefutable evidence that this legal requirement has been met. This proof of deposit is a mandatory part of the application package.

Step 6: Formal Application Submission to the MBR

Once all the statutory documents are prepared and have been duly signed by all parties, and the share capital has been confirmed as deposited, we will compile and submit the complete and finalized application package to the Malta Business Registry. This includes the signed M&A, all the supporting KYC and due diligence documents, and the proof of share capital deposit.

Step 7: Issuance of the Official Certificate of Registration

The MBR will then review the application in detail. Assuming all documents are in order and fully compliant with the Companies Act, they will officially register the company and issue the electronic Certificate of Registration. This certificate is the conclusive legal evidence that the company has been duly incorporated and now legally exists. This registration process typically takes between 2 to 5 working days from the moment of a correct and complete submission.

Step 8: Critical Post-Incorporation Procedures

The issuance of the certificate marks the birth of the company, but there are immediate and essential post-registration tasks to complete to make it fully operational. We will proceed with these on your behalf, including:

- Registering the new company for an Income Tax number with the Commissioner for Revenue.

- Applying for a VAT number, if the company’s activities require it.

- Registering the company as an employer with Jobsplus and obtaining a PE (Employer) number if you plan to hire staff.

- Finalizing the opening of the full, operational corporate bank account and providing the bank with the new certificate of registration.

What Documents Are Required for Malta Company Formation?

The primary documents required for a successful and swift Malta company formation are the bespoke Memorandum & Articles of Association (M&A), a comprehensive set of certified due diligence documents for all shareholders and directors (which must include certified passport copies and recent proof of address), and official proof from a bank of the deposited share capital. These documents are all compiled and submitted to the Malta Business Registry via a licensed and authorized Corporate Service Provider.

To ensure a smooth and delay-free registration process, it is absolutely vital to have all the necessary and correctly certified paperwork in order from the very outset. Any errors or omissions can lead to delays in the incorporation.

Comprehensive Document Checklist:

- For each individual Shareholder, Director, and Ultimate Beneficial Owner (UBO):

- Certified True Copy of Passport: The certification must be recent and performed by a recognized professional such as a lawyer, notary public, embassy official, or certified accountant.

- Original Proof of Residential Address: This must be a recent original document (less than 3 months old), such as a utility bill, bank statement, or official government correspondence that clearly shows the individual’s full name and residential address.

- Bank or Professional Reference Letter: A formal letter from a reputable bank or a professional (such as a lawyer or accountant) who has known the individual for some time, attesting to their good character and standing.

- Curriculum Vitae (CV): A detailed and up-to-date CV outlining the individual’s educational background and professional experience.

- For the Company Registration Application:

- Signed Memorandum & Articles of Association (M&A): We will draft this bespoke document for your review and signature.

- Company Name Reservation Confirmation: The official email or document from the MBR confirming that the chosen name has been approved and reserved.

- Bank Deposit Slip / Confirmation: The official proof from the bank that the minimum share capital has been paid into an account in the name of the company in formation.

- Completed MBR Application Forms: We handle the completion and submission of all official registry forms required under the Companies Act.

What Are the Capital and Share Requirements?

For a private company in Malta, the minimum authorized share capital is a very accessible €1,164.69, with at least 20% of that amount (€232.94) required to be fully paid up in cash upon incorporation. For a public company, which is designed for a much larger scale of operation, the minimum authorized share capital is €46,587.46, with at least 25% of that amount required to be paid up. A key feature of Maltese corporate law is that all shares must be registered, and anonymous bearer shares are strictly prohibited.

Understanding the specific rules and regulations around share capital is fundamental to the incorporation process and to the future structuring of your company’s ownership.

- Minimum Capital: As stated, the financial barrier to entry for establishing a private limited company is extremely low, requiring only €232.94 in accessible cash to be deposited. This makes Malta one of the most accessible jurisdictions in the EU for entrepreneurs.

- Currency: While the Euro (€) is the standard and most common currency for share capital, Maltese law is flexible. The share capital can be denominated in any major convertible currency, such as US Dollars (USD), British Pounds (GBP), or Swiss Francs (CHF), providing convenience for international shareholders.

- Types of Shares: The Maltese Companies Act allows for a great deal of flexibility in structuring the share capital. A company can issue different classes of shares (for example, ordinary shares, preference shares, and redeemable shares) with a wide variety of different rights attached to them concerning voting power, entitlement to dividends, and rights to capital return upon a liquidation. This allows for the creation of complex ownership and investment structures to suit sophisticated shareholder agreements.

- Registered Shares: A critical point of compliance is that all shares in a Maltese company must be registered. This means the name and details of the shareholder are officially recorded in the company’s statutory Register of Members, which is a matter of public record. Anonymous bearer shares, which were once common in some jurisdictions, are strictly prohibited in Malta, in line with the highest international standards on anti-money laundering and transparency.

What Are the Costs and Fees for Malta Company Formation?

The total costs for a Malta company formation are transparently divided into one-time government registration fees and ongoing annual government and compliance fees. The initial Malta Business Registry (MBR) fee for incorporation starts at a minimum of €245, while recurring annual fees include a minimum €100 MBR fee for the annual return, plus the mandatory professional costs for the annual audit and accounting services. The professional service fees charged by an advisory firm for their expert guidance and administrative support are quoted separately and are based on the specific services required.

Understanding the complete financial outlay is a critical part of planning your Malta company setup. A clear and transparent view of all costs, both initial and recurring, is essential for accurate budgeting and business planning. The costs can be broken down into three main categories: one-time incorporation fees paid to the government, recurring annual fees to maintain the company’s good standing, and the professional fees for the expert services required to manage the process.

What Are the One-Time Government Registration Fees?

The primary one-time government fee is the charge for the registration of the new company with the Malta Business Registry (MBR). This is a statutory fee that is calculated on a sliding scale based directly on the amount of the company’s authorized share capital. The fee schedule starts at a minimum of €245 for a company with a share capital of up to €1,500.

The MBR registration fee is a mandatory government charge that is payable upon the submission of the incorporation documents. The fee is designed to increase incrementally with the amount of authorized share capital, reflecting the potentially larger scale and complexity of the company.

MBR Registration Fee Scale (Examples):

| Authorized Share Capital | Registration Fee |

| Up to €1,500 | €245 |

| €1,501 – €5,000 | €350 |

| €5,001 – €10,000 | €500 |

| €10,001 – €25,000 | €600 |

| And upwards | (The fee continues to increase with capital) |

For the vast majority of startups and small to medium-sized international businesses that choose to incorporate with the minimum required share capital, the initial government fee will be the base rate of €245.

What Are the Annual Government and Compliance Fees?

The recurring annual fees consist of a mandatory fee payable to the Malta Business Registry for the filing of the company’s Annual Return, which starts at a minimum of €100 for companies with a share capital of up to €1,500. Additionally, all companies must budget for the other mandatory annual costs, which include the professional fees for an independent annual audit, ongoing accounting and bookkeeping services, and any fees for the provision of a registered office address.

To keep your company legally compliant and in “good standing,” several recurring annual costs must be considered and budgeted for.

- Annual MBR Fee: Every year, upon the filing of the company’s Annual Return, a fee is payable to the MBR. Like the initial registration fee, this is calculated on a sliding scale based on the company’s authorized share capital, with the minimum fee currently set at €100.

- Mandatory Audit Fees: It is a strict legal requirement under the Companies Act that all Maltese companies, regardless of size or activity level, must have their annual financial statements audited by an independent and Malta-registered auditor. The cost of the audit is not a government fee but is a mandatory professional expense. The fees for an audit will vary significantly depending on the volume of transactions, the complexity of the company’s financial activities, and the nature of its business.

- Accounting & Bookkeeping Fees: Proper and accurate accounting records must be maintained throughout the year to form the basis of the annual financial statements. This is another necessary professional expense, with costs depending on the level of business activity, the number of invoices, bank transactions, and employees.

How Are Professional Service Fees Structured?

The professional service fees charged by an advisory firm like Contact Advisory Services Ltd. are always discussed and quoted separately from the fixed government costs. These fees are transparent and are based on the specific and tailored services required for your unique situation. They cover our expert handling of the entire incorporation process from start to finish, our ongoing annual administration and compliance management, and our strategic advice to ensure your structure remains optimal.

While the government fees are fixed statutory charges, the true value we provide lies in our deep expertise, our efficiency in navigating the Maltese administrative system, and our comprehensive management of the entire corporate lifecycle. Our professional fees cover a wide range of essential services:

- In-depth strategic advice on corporate and tax structuring.

- The bespoke drafting of all statutory documents, including the Memorandum & Articles of Association.

- Acting as your official liaison with the MBR and other government authorities on your behalf.

- Hands-on assistance with the often-challenging process of opening a corporate bank account.

- The provision of directorship services, ongoing company secretarial and corporate administrative support.

We believe in complete and upfront transparency. Following our initial free and no-obligation consultation, we will provide you with a detailed and customized proposal. This proposal will clearly break down all expected costs, including all government fees and our own professional service fees, ensuring there are absolutely no hidden surprises or unexpected charges down the line.

What Are the Tax and Compliance Obligations of a Maltese Company?

The key tax obligation for a Maltese company is to pay a 35% corporate income tax on its profits, a rate which can be effectively and legally reduced to as low as 5% for trading activities through a well-established and EU-approved tax refund system for its shareholders. The primary annual compliance obligations include the mandatory filing of a fully audited set of financial statements, the submission of an annual corporate tax return, and the filing of a separate Annual Return with the Malta Business Registry.

Operating a company in Malta involves adhering to a clear, predictable, but strict set of annual tax and compliance requirements. Fulfilling these obligations is absolutely essential for maintaining the company’s good legal standing, avoiding penalties, and, crucially, for being able to benefit from Malta’s highly advantageous tax system.

How Does Corporate Taxation Work in Malta?

Corporate taxation in Malta is based on a standard 35% headline rate on the worldwide income for companies that are resident and domiciled in Malta. However, the system’s unique design, which incorporates a full imputation method and a generous tax refund mechanism for non-resident shareholders, can legally reduce the effective tax rate on active trading income to approximately 5% once a dividend is distributed to the shareholder.

The Maltese tax system is one of its most compelling and internationally renowned features, but it requires a proper and detailed understanding to be fully leveraged.

- The 35% Corporate Tax Rate: A Maltese company calculates its chargeable income and pays tax to the Maltese tax authorities at a flat rate of 35%.

- The Full Imputation System: This system is designed to prevent the economic double taxation of profits (i.e., being taxed once at the company level and again at the shareholder level). When the company distributes its after-tax profits in the form of dividends, the 35% tax already paid by the company is “imputed” to the shareholder as a tax credit.

- The Tax Refund System: This is the key mechanism that creates the tax efficiency. A non-resident shareholder who receives a dividend from a Maltese company is entitled to apply for and receive a refund of the Maltese tax that was paid by the company on the profits from which that dividend was distributed. The rate of the refund depends on the nature of the income:

- 6/7ths Refund: This is the most common type of refund and applies to profits derived from active trading activities. The shareholder receives a refund equivalent to 6/7ths of the 35% tax paid by the company. This results in a final effective tax leakage for the shareholder of just 5% (which is 1/7th of 35%).

- 5/7ths Refund: This refund applies to dividends paid from passive income sources, such as interest or royalties.

- 100% Refund (via the Participation Exemption): For dividends and capital gains that a Maltese company derives from a qualifying “participating holding” (which is generally defined as holding at least 5% of the equity in another company), the shareholder can claim a full, 100% refund of the tax paid. This results in a 0% effective tax rate, making Malta a premier and highly sought-after jurisdiction for establishing international holding companies. This structure is particularly beneficial for complex financial operations, such as those requiring an EMI License, where efficient profit repatriation is key.

What Are the Annual Accounting and Auditing Requirements?

Every Maltese company, without exception, is legally required to maintain proper and accurate accounting records throughout its financial year. At the end of each financial year, the company must prepare a full set of financial statements (including a balance sheet, profit and loss account, and cash flow statement) which must then be professionally audited by an independent, Malta-registered and certified auditor.

Compliance with these accounting and auditing standards is not optional; it is a strict legal requirement enshrined in the Maltese Companies Act, and failure to comply can result in significant penalties.

- Bookkeeping: All companies must keep accurate and up-to-date accounting records that correctly explain all their transactions and reflect their true financial position at any given time. This includes maintaining organized records of all sales invoices, purchase invoices, receipts, bank statements, and other relevant financial documentation.

- Preparation of Financial Statements: After the company’s chosen financial year-end, a full set of statutory financial statements must be prepared in accordance with International Financial Reporting Standards (IFRS).

- Mandatory Annual Audit: The prepared financial statements must then be subjected to a full audit by a certified public accountant and registered auditor in Malta. The auditor provides an independent, professional opinion on whether the accounts present a “true and fair view” of the company’s financial performance and position.

- Approval and Filing: The final, audited financial statements must be formally approved by the company’s board of directors and then presented to and approved by the shareholders at the company’s Annual General Meeting (AGM). They must then be filed with the Malta Business Registry, where they become a matter of public record.

What Are the Ongoing Compliance Filings?

The key ongoing compliance filings for a Maltese company, in addition to the audited accounts, are the Annual Return, which is submitted to the MBR, the annual Corporate Income Tax Return, which is filed with the Commissioner for Revenue, and periodic VAT returns if the company is VAT registered. Accurately meeting the deadlines for these filings is crucial to ensure the company remains in good legal and fiscal standing.

Beyond the annual audit, there are several other recurring deadlines that must be managed to ensure full compliance.

- Annual Return: This is a completely separate filing from the audited accounts. It is essentially a snapshot of the company’s corporate details (such as the list of shareholders, directors, and the share capital structure) on the specific anniversary date of its incorporation. It must be filed annually with the MBR within 42 days of this anniversary date.

- Corporate Tax Return: A comprehensive tax return, supported by the audited financial statements, must be filed annually with the Commissioner for Revenue. This return declares the company’s taxable income for the year and calculates the tax due. The deadline for filing is typically nine months after the company’s financial year-end.

- VAT Returns: If the company’s turnover exceeds the registration thresholds, it must register for Value Added Tax (VAT). Once registered, it must file periodic VAT returns (usually on a quarterly basis). These returns declare the sales tax (output VAT) collected from customers and the input VAT paid on business expenses.

- UBO Register: In line with EU anti-money laundering directives, all companies are required to maintain an up-to-date internal register of their Ultimate Beneficial Owners (UBOs) and to submit this sensitive information to the MBR’s central UBO register. Any changes to the UBO must be reported promptly.

Managing these various deadlines and complex requirements is a core part of the corporate administration services we provide, allowing our clients to focus on their core business activities with peace of mind. The ever-increasing complexity of the regulatory environment, especially for financial institutions, makes expert guidance indispensable, particularly when seeking advanced regulatory permissions like an EMI License.

How Do You Open a Corporate Bank Account in Malta?

Opening a corporate bank account in Malta is a critical post-incorporation step that requires the through preparation of comprehensive due diligence documents and a clear presentation of the company’s business model to the chosen financial institution. While the company exists legally upon registration , it cannot become fully operational without a bank account, a process that our firm is expertly positioned to facilitate.

Why Can Bank Account Opening Be Challenging?

The process of opening a corporate bank account has become increasingly rigorous in recent years. Maltese banks, in line with stringent EU anti-money laundering (AML) and counter-terrorism financing (CTF) directives, are legally mandated to conduct enhanced due diligence on all new corporate clients, particularly those with international ownership structures. This is not a procedural formality but a deep investigation into the company’s proposed activities, its beneficial owners, and the source of its initial and ongoing funding. This rigorous scrutiny is essential to uphold Malta’s reputation as a clean and compliant financial jurisdiction. For unprepared applicants, this can result in significant delays or even outright rejection of the application.

What Is the Typical Process and What Documents Are Required?

The bank account opening process begins with selecting a suitable bank and submitting a detailed application. Banks will require a complete set of corporate documents, including the Certificate of Registration and the Memorandum & Articles of Association , alongside the same level of due diligence documents required for incorporation, such as certified passport copies and proof of address for all directors and shareholders.

However, the banks’ requirements almost always go further. You should be prepared to submit:

- A detailed and coherent Business Plan, outlining the company’s activities, target markets, and projected turnover.

- Comprehensive information on the Source of Wealth and Source of Funds for the ultimate beneficial owners to demonstrate the legitimacy of the capital being introduced.

- The professional

Curriculum Vitae (CV) of the directors, showcasing their experience relevant to the proposed business activities.

Our role is to leverage our strong relationships with local and international banks to pre-emptively address their concerns, ensure your application package is complete and professional, and guide you through the entire process to secure a successful outcome.

What Are the Economic Substance Requirements for a Malta Company?

Establishing genuine economic substance in Malta involves creating a demonstrable and verifiable link between the company and its jurisdiction of incorporation through local management, physical presence, and tangible business activities. This is a critical requirement to ensure the company is recognized as a tax resident of Malta and to comply with international tax standards set by the EU and OECD.

What Is Economic Substance and Why Is It Crucial?

Economic substance is the proof that a company is not merely a “shell” or “letterbox” entity created solely for tax advantages. International tax initiatives are designed to ensure that profits are taxed where the real economic value is created. Therefore, a Maltese company, particularly one benefiting from the tax refund system, must be able to prove that its core income-generating activities are genuinely managed and performed in or from Malta. Failure to demonstrate adequate substance can result in the denial of tax treaty benefits, challenges from foreign tax authorities, and significant reputational damage.

How Can a Company Establish Genuine Substance?

While every company must have a registered office address in Malta as a legal minimum, robust substance typically requires more. The specific level of substance needed will depend on the scale and nature of the company’s activities, but the key elements include:

- Management and Control: Appointing qualified directors who are resident in Malta can be a powerful indicator that strategic decisions are being made locally. We can provide professional, highly qualified directors to fulfill this need.

- Physical Presence: This can range from securing a dedicated office space to utilizing co-working facilities, depending on the business’s needs. A physical presence provides a tangible footprint in the jurisdiction.

- Local Employees: Hiring staff in Malta, whether on a full-time or part-time basis, is one of the strongest indicators of genuine local economic activity. The company must be registered as an employer to do so.

Strategically structuring your company to meet these substance requirements is not just a compliance exercise; it is a fundamental step in building a resilient and sustainable international business platform.

What Is the Post-Incorporation Timeline for a New Maltese Company?

The issuance of the Certificate of Registration is the successful legal birth of your company, but it is the beginning, not the end, of your corporate journey. To ensure your new Maltese entity remains in good standing and becomes a fully operational asset, it is crucial to follow a clear timeline of post-incorporation procedures and annual compliance milestones. This roadmap illuminates the critical first-year events that we will expertly manage on your behalf, transforming a series of complex obligations into a seamless and predictable process.

Phase 1: The First 30 Days – Activation & Foundation

This initial phase is about transforming the newly registered company from a legal certificate into a fully functional business entity. Speed and precision are key.

- Corporate Bank Account Finalisation: We immediately provide the Certificate of Registration to the bank to unlock full operational capabilities for your corporate account, enabling you to send and receive funds globally.

- Comprehensive Tax Registration: We register the company with the Commissioner for Revenue to obtain its official Income Tax number and, if required, its VAT number. This formally integrates your company into the Maltese fiscal system, a prerequisite for compliant trading.

- Employer Registration: For companies planning to build a local team, we register you as an employer with Jobsplus. This foundational step is essential for establishing economic substance and tapping into Malta’s skilled workforce.

Phase 2: The First 6-12 Months – Operational Rhythm & Compliance Preparation

This period is dedicated to establishing the disciplined routines that ensure effortless year-end compliance.

- Accurate Bookkeeping: We establish a robust bookkeeping system, maintaining accurate and organised records of all financial transactions. This is not just a legal requirement but the bedrock of sound financial management and the basis for your annual audit.

- VAT Compliance: For VAT-registered companies, we manage the periodic filing of VAT returns, ensuring you remain compliant with your obligations while recovering any eligible input VAT to optimize cash flow.

Phase 3: The First Fiscal Year-End and Beyond – Annual Compliance & Strategic Review

The end of the company’s first financial year triggers the main annual compliance cycle. This is where our expertise ensures a smooth and penalty-free process.

- Preparation of IFRS Financial Statements: Following the year-end, our accounting team prepares a full set of financial statements in accordance with rigorous International Financial Reporting Standards (IFRS).

- Mandatory Annual Audit: The financial statements are submitted for a mandatory audit by an independent Maltese auditor. This provides an official, third-party validation of your company’s financial health, enhancing its credibility with banks, partners, and authorities.

- Annual Filings: We manage the three critical annual filings: the Annual Return with the MBR, the Audited Financial Statements with the MBR, and the Corporate Tax Return with the tax authorities, ensuring all strict deadlines are met. This annual cycle is the ultimate demonstration of your company’s good standing and a prerequisite for benefiting from the tax refund system.

How Does Malta Compare to Other EU Jurisdictions?

While several EU jurisdictions offer compelling fiscal advantages, Malta’s unique and powerful combination of a low effective tax rate achieved through a full imputation and refund system, its status as a highly reputable onshore financial centre, and its exceptional accessibility for SMEs and startups makes it a superior and more holistically balanced choice for a vast range of international business models. The strategic decision of where to establish a European base requires a nuanced comparison. While competitors like Cyprus, Ireland, Luxembourg, the Netherlands, and Estonia each present their own advantages, the Maltese framework often provides a more flexible, cost-effective, and sustainable long-term solution.

The following table provides a high-level overview of the key differences:

| Feature | Malta | Cyprus | Ireland | Estonia | Luxembourg | Netherlands |

| Effective Tax (Trading) | 5% | 12.5% | 12.5% | 0% (if reinvested) | ~25% | ~25% |

| Tax on Distributed Profit | Included in 5% rate | Included in 12.5% rate | Included in 12.5% rate | 20% | N/A | N/A |

| Holding Company Regime | 0% (via refund/exemption) | 0% (via exemption) | 0% (via exemption) | 0% | 0% (via exemption) | 0% (via exemption) |

| Primary Advantage | Flexible Tax Refund System | Simplicity & Non-Dom Regime | Access for Large Multinationals | Tax Deferral on Profits | Sophisticated Holding Structures | Extensive Treaty Network |

| Best Suited For | SMEs, Holding Co’s, Startups | Holding Co’s, IP, Individuals | Large Tech & Pharma | Tech Startups reinvesting profits | Large Corporate & Fund Structures | Royalty/Licensing & Holding Co’s |

Malta: The All-Round Strategic Choice

Malta’s genius lies not just in a low tax rate, but in the intelligent, EU-approved mechanism used to achieve it. A Maltese company is fully tax-compliant at the standard 35% rate, reinforcing its strong international reputation. Upon a dividend distribution, shareholders can then claim a refund that drives the effective tax burden down to an attractive 5% on trading income or a remarkable 0% for holding structures. This unparalleled flexibility, combined with its stable Eurozone economy and skilled English-speaking workforce, makes establishing genuine substance a straightforward process for businesses of all sizes.

Comparison with Cyprus

Cyprus offers a simple and appealing flat 12.5% corporate tax rate and a beneficial non-domicile regime for individuals. While this simplicity is attractive, Malta’s two-stage system provides greater strategic flexibility in financial planning, as the tax efficiency is triggered by the profit distribution. For businesses that need to strategically retain and reinvest profits before distribution, Malta’s model allows for more nuanced control over when the tax event occurs.

Comparison with Ireland

Ireland is a global heavyweight, successfully leveraging its 12.5% tax rate to attract the world’s largest multinational corporations in tech and pharmaceuticals. However, this regime is best suited for large-scale operations with the resources to meet significant and often costly substance requirements. For startups, entrepreneurs, and SMEs, Malta company formation is vastly more accessible, offering a low barrier to entry without compromising on the benefits of a reputable, onshore EU jurisdiction.

Comparison with Estonia

Estonia’s model of 0% tax on reinvested profits is highly innovative and ideal for tech startups focused exclusively on aggressive growth. The critical difference, however, is the 20% tax levied upon profit distribution. Malta’s system, by contrast, offers shareholders a cash refund, providing immediate liquidity and a predictable 5% final tax leakage. This makes the Malta company setup superior for any business that requires regular distribution of profits to its investors.

Comparison with Luxembourg & the Netherlands

Luxembourg and the Netherlands are premier jurisdictions for large, complex international holding and financing structures. Their sophisticated legal frameworks and extensive tax treaty networks are tailored for multinational corporations, investment funds, and significant wealth management operations. However, this sophistication comes with higher setup costs, greater administrative complexity, and more demanding substance requirements. Malta offers many of the same holding company benefits (such as the 0% participation exemption) but within a far more accessible and cost-effective framework, making it the ideal choice for SMEs and family offices seeking the same efficiency as larger corporations.

Why Should You Choose Contact Advisory Services Ltd. for Your Malta Company Setup?

You should choose Contact Advisory Services Ltd. for your Malta company setup because we are a highly experienced and fully MFSA Authorized Company Services Provider based directly in Malta, offering a truly comprehensive, integrated, one-stop solution for both company formation and ongoing administration. Our dedicated team of experts provides personalized, strategic guidance to ensure your corporate structure is not only established efficiently but is also optimally designed for tax efficiency, long-term compliance, and perfect alignment with your unique international business objectives.

When you make the strategic decision to register company in Malta, the partner you choose to guide you through this intricate process is arguably as important as the jurisdiction itself. Your Corporate Service Provider is your official representative on the ground, your expert navigator through the labyrinth of local regulations, your shield against compliance pitfalls, and your long-term partner in ensuring the ongoing good standing and success of your enterprise.

What Expertise and Authorization Do We Offer?

We offer deep, practical expertise built over many years of dedicated practice in the specialized fields of Maltese corporate law, international tax structuring, and regulatory compliance. Crucially, Contact Advisory services Ltd. is fully authorized and regulated by the Malta Financial Services Authority (MFSA) to act as a Company Service Provider. This official designation is not easily obtained and serves as your guarantee that we are held to the highest possible standards of professionalism, technical competence, ethical conduct, and rigorous compliance.

Our authorization by the MFSA is not just a license; it is your ultimate assurance of quality, security, and trustworthiness. It means we are subject to constant and rigorous oversight by the financial regulator and are legally required to adhere to strict regulatory standards that are designed to protect you, the client. Our team is composed of highly qualified and experienced professionals, including lawyers, accountants, and corporate administrators with specialized knowledge in their respective fields. We don’t just fill out forms; we engage in a deep analysis of your needs to provide proactive, strategic advice, ensuring your Malta company formation is built on a solid, sustainable, and future-proof foundation. We have a proven and demonstrable track record of successfully assisting clients from a multitude of diverse sectors, from digital marketing and e-commerce ventures to highly complex financial services firms seeking regulated licenses, such as the EMI License.

What Is Our Comprehensive Service Approach?

Our comprehensive service approach is carefully designed to function as a seamless and efficient “one-stop shop” for our valued clients, covering every single aspect of a company’s lifecycle from inception to dissolution. We handle absolutely everything, from the initial high-level strategic advice and incorporation process to the day-to-day and year-on-year ongoing administration, accounting, tax compliance, and corporate governance. This integrated model provides you with a single, dedicated, and accountable point of contact for all your corporate needs in Malta.

We firmly believe in building strong, long-term partnerships with our clients, based on trust and mutual success. Our service does not simply end once your company’s certificate of registration is issued. We provide a complete and holistic suite of services to ensure your company remains fully compliant, efficient, and runs smoothly, year after year.

Our Integrated Services Include:

- Company Formation & Domiciliation: We manage the entire incorporation process from start to finish and provide a prestigious registered office address in Malta.

- Corporate Administration & Secretarial Services: We handle all company secretarial duties, including the preparation of board resolutions and shareholder minutes, maintaining all statutory records, and ensuring all MBR filings are completed accurately and on time.

- Bank Account Opening Assistance: We leverage our strong and long-standing relationships with a wide range of local and international banks to expertly guide and assist you through the often complex and challenging process of opening your corporate bank account.

- Professional Accounting & Bookkeeping: Our in-house accounting team will maintain your company’s books and records accurate and in full accordance with IFRS standards.

- Tax Compliance & Strategic Advisory: We prepare and file all corporate tax returns, manage your VAT compliance obligations, and provide proactive, strategic tax advice to ensure your structure remains as efficient as possible.

- Directorship & Fiduciary Services: Where required for substance or other strategic reasons, we can provide professional, highly qualified directors and nominee shareholders, all in full compliance with the strict regulations of the MFSA.

- Dedicated Ongoing Support: We act as your dedicated, single point of contact for any and all corporate, legal, or administrative matters that may arise during the life of your company.

This holistic and integrated approach saves you invaluable time, dramatically reduces administrative complexity, and provides you with the peace of mind that all aspects of your company’s administration are being handled professionally, cohesively, and strategically, all under one roof.

Ready to Start Your Business in Malta?

The journey of Malta company formation is a definitive and powerful strategic move that positions your business at the very heart of the European Union, arming it with significant and sustainable financial and operational advantages. From the unparalleled 5% effective tax rate to the stability, credibility, and prestige of a fully compliant EU jurisdiction, the benefits are clear, compelling, and actionable. However, navigating this process successfully requires precision, deep local expertise, and a trusted, professional local partner.

At Contact Advisory Services Ltd., we are more than just incorporation agents; we are your dedicated strategic partners, committed to building a compliant, efficient, and successful foundation for your business in Malta. We have distilled the complex and often daunting process of a Malta company setup into a streamlined, transparent, and predictable service. We handle every single legal, administrative, and compliance detail, allowing you to focus on what you do best: driving the growth and success of your business.

Take the next decisive step towards your European success story.

Contact our expert team today for a free, comprehensive, and no-obligation consultation. Let’s discuss your specific project and allow us to show you how we can help you register company in Malta with absolute confidence and strategic clarity.

Contact Us:

- Email: info@contact.com.mt

- Phone: +356 2757 7000

- Or fill out our online inquiry form to get started.

FAQs - Malta Company Formation / Registration

Why do companies register in Malta?

Malta’s strategic location within the EU, its English-speaking environment, a strong work ethic, and a favorable taxation system make it an attractive jurisdiction for company registration. Its EU membership provides access to the European market, while its tax system offers potential benefits for international businesses.

Is Malta an offshore jurisdiction?

What are the main types of companies that can be registered in Malta?

How many directors and shareholders are required in a Maltese company?

What capital does a Maltese company need?

What documents are required to incorporate a company in Malta?

Are there any company name restrictions?

Do I need to have a physical address in Malta?

How long does it take to set up a Malta company in total?

The timeframe for Malta company formation can vary, but generally, it takes between 1 to 3 weeks from the submission of all required documents. The time for onboarding is usually determined by the responsiveness of the client in providing the requested due diligence documents and payment. Other factors influencing this timeline include complexity of the company structure and the efficiency of document processing by the Malta Business Registry (MBR).

What steps are needed to form a new company in Malta?

The key steps include:

- Choosing a company name and verifying its availability.

- Drafting the company’s Memorandum and Articles of Association.

- Appointing directors and shareholders.

- Submitting the required documents to the Malta Business Registry (MBR).

- Paying the registration fees.

- Obtaining a company registration certificate.

- Applying for a Tax Identification Number (TIN).

How do you register a company online in Malta?

What is the cost of registering a company in Malta?

What information is required for the Beneficial Owners of company?

Information regarding the Beneficial Owners is required to comply with Anti-Money Laundering Regulations. This includes:

- Full legal name.

- Date of birth.

- Nationality.

- Residential address.

- Nature and extent of the beneficial interest held.

What happens following submission to the Registrar of Companies?

What are the ongoing obligations of a registered company in Malta?

Ongoing obligations include:

- Filing annual returns.

- Maintaining accurate accounting records.

- Paying annual return fees.

- Complying with tax regulations.

- Submitting audited financial statements.

What are the annual document filing obligations?

What do I need to close a company in Malta?

To close a company in Malta, you will typically need to:

- Pass a resolution for dissolution.

- Settle all outstanding debts and liabilities.

- Prepare final financial statements.

- Submit a dissolution application to the Malta Business Registry (MBR).

- Obtain a tax clearance.

How much is the VAT in Malta?

What is the company tax rate in Malta?

Is Malta tax-free?

Can a Malta company have foreign directors and shareholders residing outside of Malta?

What are the benefits of having a registered agent in Malta?

A registered agent in Malta provides essential services, including:

- Maintaining the company’s registered office.

- Handling official correspondence from the MBR and other authorities.

- Ensuring compliance with local regulations.

- Providing a local point of contact for your business.

Are there any specific industries that are particularly advantageous to register in Malta?

Malta has become a hub for several industries, including:

- Online gaming.

- Financial services.

- Maritime services.

- Aviation

- Pharmaceuticals

- Information technology.

These sectors benefit from Malta’s regulatory framework and business environment.

What is the process for obtaining a Tax Identification Number (TIN) for a Malta company?

After the company is registered with the MBR, an application for a TIN is submitted to the Inland Revenue Department. This process is typically straightforward and can be facilitated by your registered agent or corporate service provider.

What are the requirements for maintaining accounting records for a Malta company?

Malta companies are required to maintain accurate and up-to-date accounting records. This includes:

- Keeping records of all transactions.

- Preparing annual financial statements.

- Ensuring compliance with Maltese accounting standards.

- Retaining records for a set number of years.

Are there any double taxation agreements that Malta has in place?

Why should I use Malta company formation agents?

Engaging Malta company formation agents can streamline the entire process, providing expertise on legal requirements, handling documentation, assisting with bank account opening, and ensuring compliance with local regulations, saving you time and effort.

Ready to Register a Company in Malta and Launch your Malta Business?

We’ve addressed the most common questions about Malta company formation. For personalized assistance and to ensure a smooth setup process, contact us today. Our experts are ready to guide you through every step. Explore our news section for more detailed articles and resources to further your understanding.

Get in touch with our experts at info@contact.com.mt